Medifast produces, distributes and sells a wide range of 137 nutritional products and offers coaching services with nearly 61,000 active coaches at the time of writing. The products are sold through the internet and are delivered directly to your home. It generates 100% of its turnover in the United States. These nutritional programs, along with the delivery of prepared meals, make up 90% of the company's sales. However, it is the Opta Via coaching model that has driven Medifast's growth. The company accompanies a person's physical transformation with individual support and access to a community of motivated people. The client retention rate is also very high (77%). As proof, 90% of Opta Via coaches were previously clients. Medifast relies on a virtual circle in which clients become coaches who in turn activate clients who will become coaches.

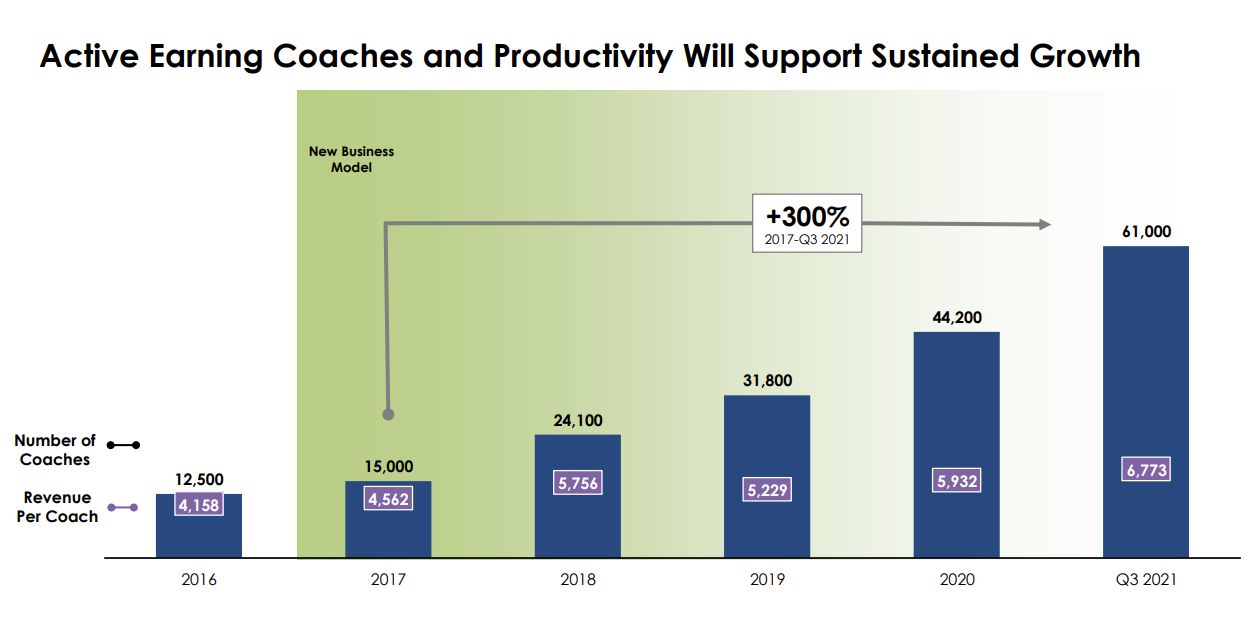

Since 2017, the new business model based on the increase of the number of coaches supports the growth:

Source: Medifast - Q4 2021 results presentation

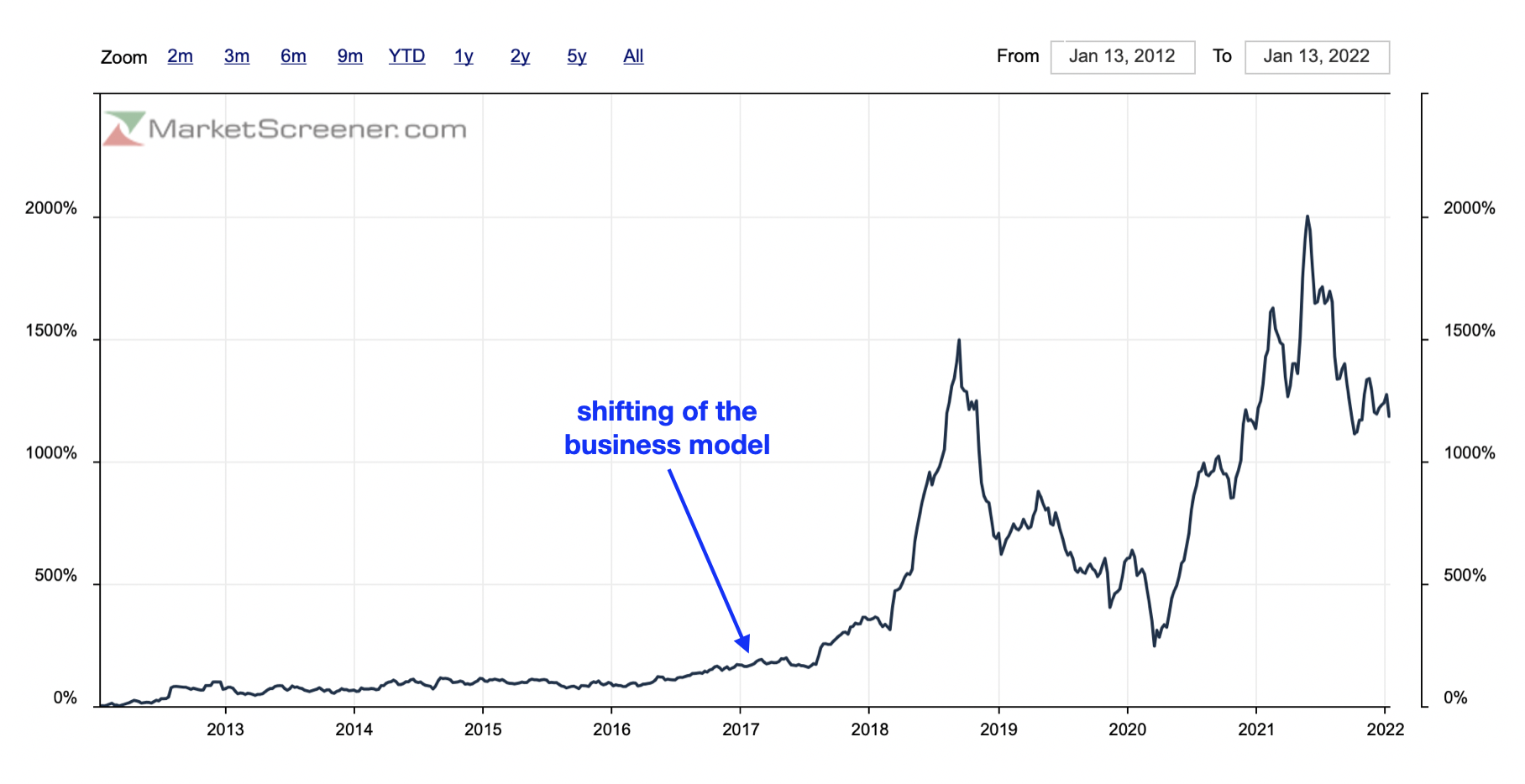

The share price has increased by more than 1200% in the last ten years:

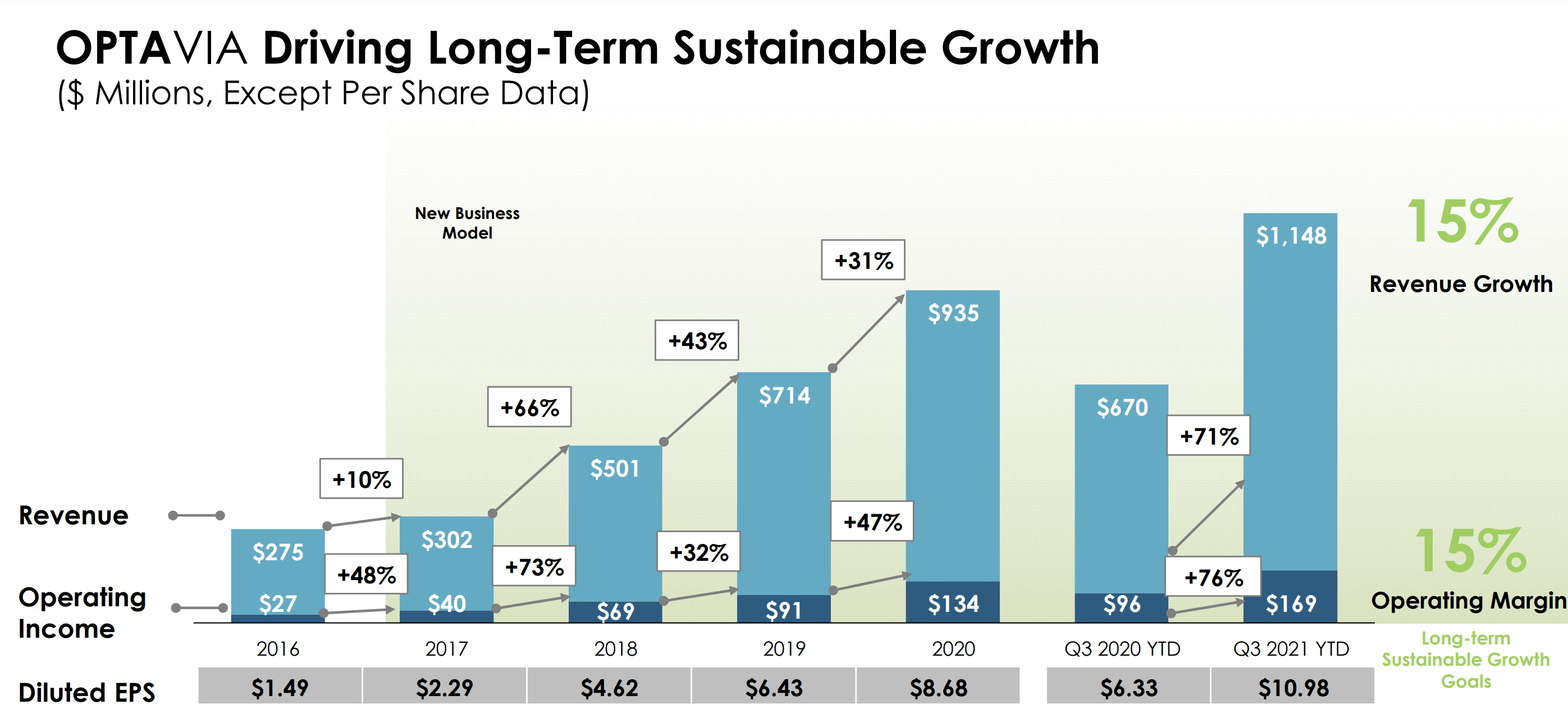

The company is now chaired by Daniel R. Chard, whose pedigree - more than 25 years of experience in consumer products and services and successful stints at Nu Skin, Pillsbury and Arthur Andersen - is on par with that of Ulf Mark Schneider (current CEO of Nestlé). Speaking of management, they are aiming for sustainable growth in sales and operating profit of around 15% per year. Given the track record of delivering results in line with expectations, this seems consistent, even conservative. The market on which the company is positioned is almost infinite, that of health, nutrition and self-esteem. And in this market, Medifast is one of the fastest growing companies with a CAGR (average annual revenue growth) from 2017 to 2021 of 50%. This growth is entirely self-financed and the company has not had to resort to capital increases or increases in debt.

Evolution of Medifast's income statement since 2011 :

.png)

Source: MarketScreener

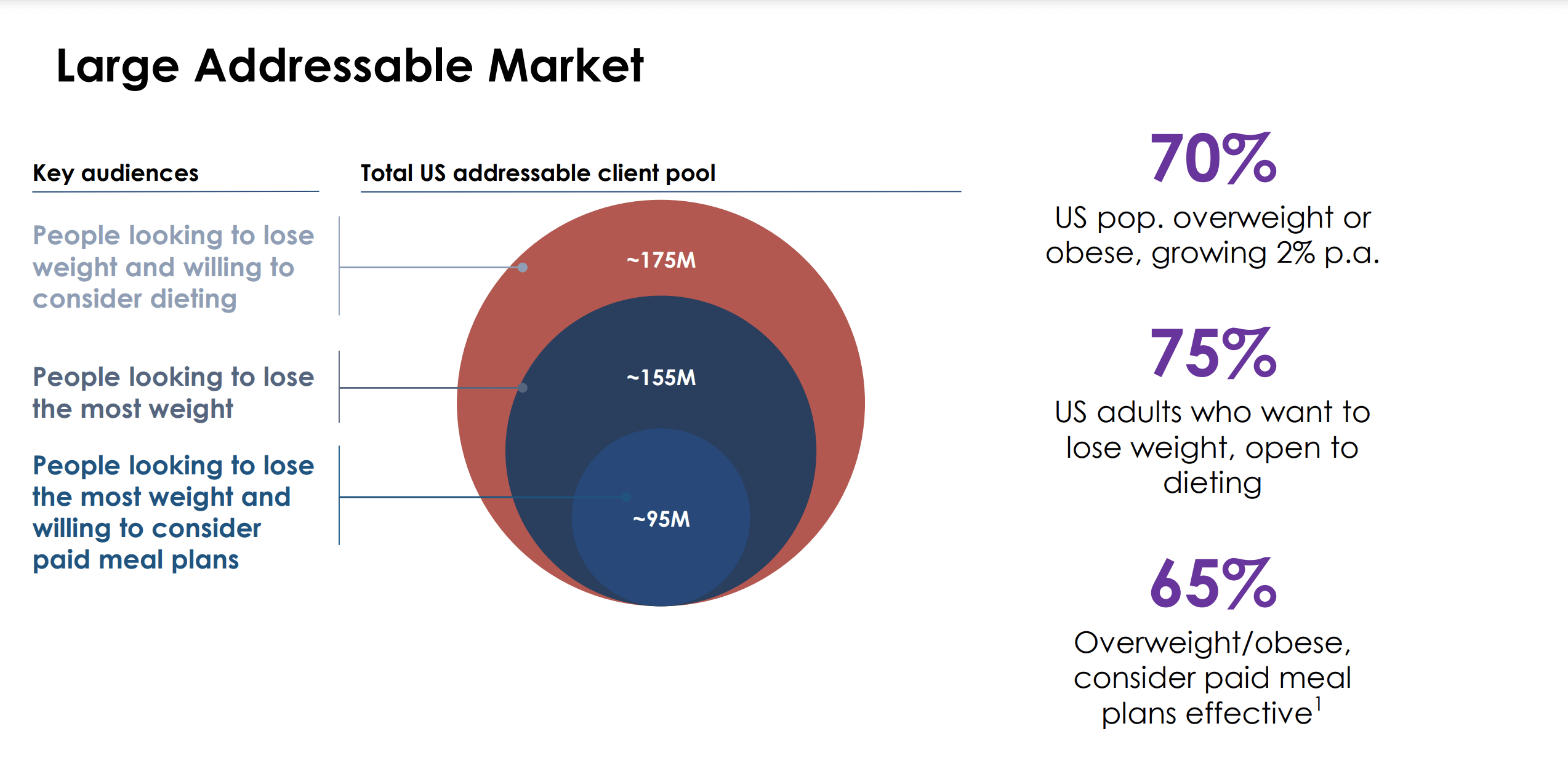

If Medifast has already helped more than 2 million people to improve their diet, many other potential customers could use their services, especially in the United States where obesity is breaking records. Indeed, more than 70% of the American population is overweight, 40% of which is considered obese, and these figures are growing at a rate of 2% per year. Faced with this trend, more and more people want to take care of their health through nutrition and sports. In fact, 75% of Americans say they want to lose weight or follow a nutritional program and 63% have adopted new health habits since the beginning of the covid-19 pandemic. This movement is reinforced by the importance of self-image in the digital age and the democratization of home meal delivery, both of which were reinforced by the pandemic.

Source : Medifast

Medifast has a business model that is almost too good to be true. Its very low capital-intensive activity (low CAPEX, low working capital requirements) has enabled it to be profitable quickly and to maintain its excellent financial health quite easily. Over the last five years, capital expenditures have been in the range of 1 to 1.5% of sales. The company has achieved high profitability with a return on equity of around 91% in 2021 and a return on net assets of around 61%. Profitability is good and above the sector with an operating margin of 11.3% and a net margin of 8.5% in 2021. This profitability tends to increase over time with a gross margin (74.2%) that remains unchanged and operating expenses that are constantly decreasing.

Source : Medifast

Free cash flow is well oriented for shareholders with 45% in dividend payments, 28% in share buybacks and 22% in investment in the future growth of the company. With a quick ratio of 1 and a current ratio of 1.9 (these ratios are used to check the company's liquidity, especially in a stressful situation when the company cannot sell its inventories), the company has a certain financial strength to anticipate potential short-term hard times. On the one hand, it is in a net cash position (cash > debt) and total debt represents only 10% of equity.

The valuation remains quite reasonable. The company is valued at 14.4 times its 2021 earnings and 11.6 times its 2022 forecast earnings, i.e. a PEG (Price-to-earning-growth, the most useful ratio for identifying a GARP share) of 0.60. We consider that a GARP stock must be close to 1 to be considered as such. Here we are almost twice as cheap. With the current market valuation, Medifast is paying less than its historical 19.7 times earnings.

.png)

Source: MarketScreener

The CEO, Daniel R. Chard, owns about 1% of the company, or $25 million. That's the minimum threshold I like to see to say that the principal is in a "skin in the game" situation. The rest of the management team is also invested in a personal capacity. Among them, a few names own more than $1 million in Medifast stock: James P. Maloney (CFO), Kevin G. Byrnes (Director), William Baker (Vice President of Information Technology), Jeffrey J. Brown (Director), Scott Schlackman (Director) or Constance J. Hallquist (Director). This involvement leads them to think like investors and to see their assets correlated to their operational performance. It's always reassuring to see that, especially when the business model seems too good to be true as it is here.

To sum up, we think this stock is a good diversification choice if you are looking for a GARP stock. We chose it for our U.S. stock selection because of its fundamental qualities of growth and profitability driven by a unique business model. It remains a rather volatile mid-cap, so be careful. We will keep an eye on the next earnings releases to see if growth continues as expected.

The author had a short or long position during the writing and publication of this article.

By

By