|

|

| This week's gainers and losers |

Gainers: This week's top gainers include Imago BioScience, which soared after announcing that it had been acquired by Merck for $1.35 billion, which represents a nearly 107% premium. Merck wants to strengthen its presence in the field of hematology +105%. After days of rumors, the Glazer family, who owns Manchester United, confirmed that it is considering the future of its stake in the soccer club. If there is a good offer, a sale is likely. +59.2 % Mirati Therapeutics is reportedly being courted by pharmaceutical majors. The oncology specialist is attracting more interest since its rival Seagen chose to remain independent, and it has a treatment in the approval process. It is up +27.4% Best Buy reported better-than-expected quarterly results, raising its annual revenue guidance. The market likes it. The retailer is up 15.1% for the week.

Losers: Among losers, Dr. Martens, the shoe maker, warned that its margins will be down this year, because demand is weaker than expected, hampered by a difficult context. The British company gives up 26.7%. Jack in the Box disappoints. The fast-food chain unveiled timid forecasts for next year when it announced its quarterly results, which were in line with expectations. The group's costs have also increased with the acquisition of Del Taco. -15.7% Lucid Group: Shares in the luxury electric vehicle fell 11.1% after a Barron's report about defects in the cars. Dollar Tree: The retailer lowered its annual profit forecast, dragging down its shares about 7.5%. |

|

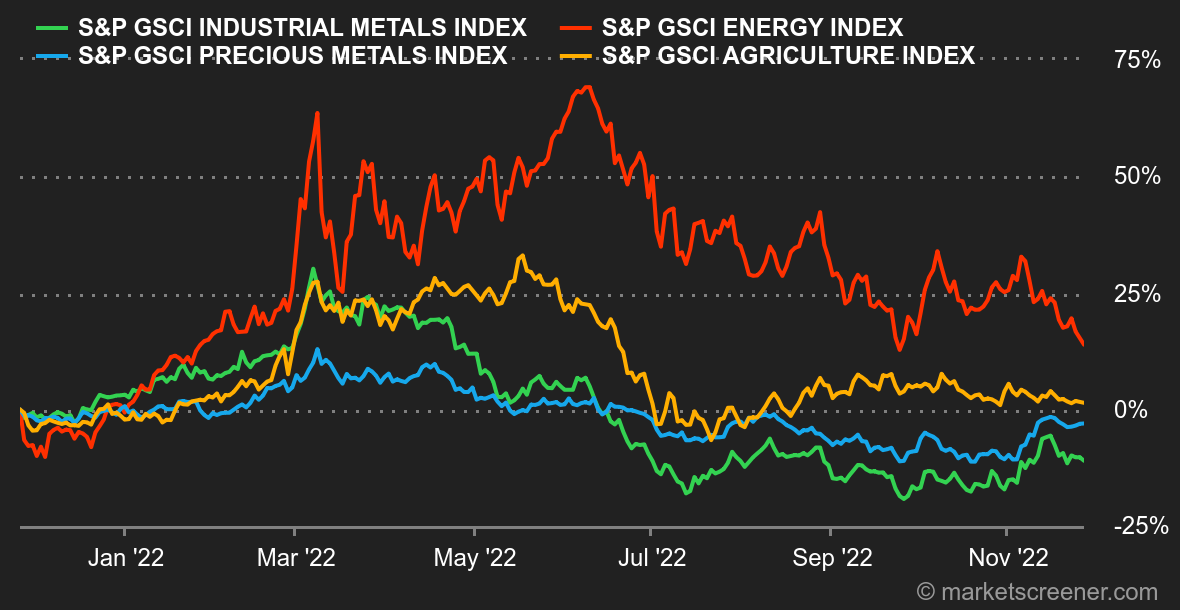

| Commodities |

| Energy: Oil markets remain under pressure and are giving up ground again this week. The European Union is reportedly considering capping the price of Russian oil at $65-70. Russian oil is already trading at a significant discount to Brent (Urals is currently trading at around USD 67 per barrel). We can therefore deduce that this ceiling price should not affect Russian production that much. The latter is therefore not expected to decrease significantly in the coming months, which partly explains the weakness of oil prices in recent days. North Sea Brent is trading at around USD 86 while US WTI is trading at USD 79 per barrel. In Europe, gas prices are stabilizing around EUR 123/MWh for the Dutch reference (Rotterdam TTF). Russia is accusing Ukraine of storing gas in transit on its territory and destined for Moldova. Gazprom is threatening to reduce its flows via Ukraine. Metals: Industrial metals were down overall, hampered by concerns about new health restrictions in China. Covid is pushing the Chinese authorities to once again confine several cities and districts. In other words, the market still has to wait to play out the scenario of an outright recovery in demand for metals. Copper is trading slightly above USD 8,000 per tonne on the LME. In precious metals, gold is treading water at USD 1,750. Also on the precious metals front, the World Platinum Investment Council is forecasting a deficit market for platinum next year, the first since 2020. The Institute points to strong demand from the automotive industry (whose needs are expected to grow by 3.3% year-on-year) while global supply is expected to grow by only 2%. Platinum is trading at around USD 985. Agricultural commodity: Ukraine estimates that it will be able to export 13 million tons of wheat in the 2022/2023 season, a significant drop since the country exported nearly 20 million tons of wheat the previous year. Wheat is trading below 800 cents a bushel in Chicago, compared to 660 cents for corn. |

|

| Macroeconomics |

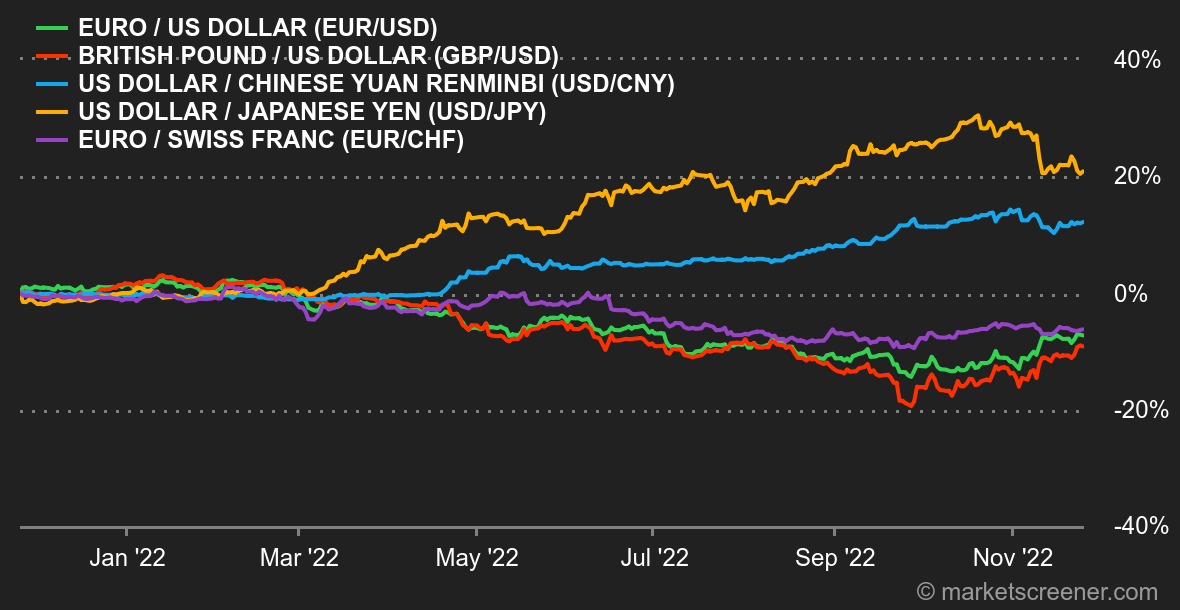

| Atmosphere: It's confusing but it's rising. Economic indicators continue to tell one story, rates another and stocks a third. How can you tell the difference? November's European PMI indicators are better than economists were expecting. In the US, they remain weak, but durable goods orders are stronger than expected and consumer sentiment is picking up. Fortunately for equity markets, investors welcomed the minutes of the last Fed meeting. They saw signs that the central bank is becoming less inflexible in its stance on the pace of rate hikes. This will be confirmed or denied next Wednesday with an important speech by Jerome Powell. Currencies: It was a good week for the British pound, which regained ground against most currencies. This is due to continued strong inflation numbers in the UK, as this forces the central bank to raise rates. But forex traders are cautious about the sustainability of the phenomenon, given the state of the British economy. The GBP is trading at USD 1.2104 and EUR 1.1619. The European currency also gained ground against the dollar at USD 1.0418, before falling back below USD 1.04 on Friday. This is not unrelated to a new measure decided by the Chinese central bank to try to revive its economy. Rates: In the United States, the bond market continues to play the tune of a slowdown in rate hikes by the US central bank. The 10-year went from 3.78% a week ago to 3.71%. Shorter maturities are still reversed in anticipation of a marked economic slowdown, which is slow to materialize. In Europe, the Bund is still below 2% on 10 years despite a sharp rebound on Friday. The French OAT is hovering around 2.4%, while Swiss debt is paying 1% over 10 years. Crypto-currencies: Bitcoin is still reeling from what happened with the FTX scandal. The digital currency is slightly back in positive territory this week, recovering +1.73% to hover around $16,500 at the time of writing. With confidence having completely evaporated from the cryptocurrency ecosystem, the digital asset market is likely to take many weeks to become attractive to a good number of investors again. While waiting to feel a renewed optimism on crypto-currencies, Amazon and Apple are on track to produce, for the former a series, for the latter a movie, on the FTX chaos. Enough to make aficionados of the cryptosphere wait... Calendar: The macro agenda is packed this week with the Conference Board's US consumer confidence index on Tuesday. On Wednesday, the first estimate of November inflation in Europe, a new estimate of U.S. GDP in Q3, the JOLTS survey on job openings and an important speech by Fed boss Jerome Powell. Thursday in the US, PCE inflation and ISM manufacturing are on the agenda. With the bonus of an OPEC meeting. As for Friday, it includes a speech by Christine Lagarde and the US employment figures for November. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By