The Fed has probably completed its monetary tightening cycle. In any case, that's the tone of most of the comments that have appeared on the web following the governors' meeting. But let's start again in order. At the beginning of the week, the BoJ once again unraveled its Yield Curve Control before its outright abandonment, which could take place in 2024. Forex traders were clearly expecting better, since following the announcement, the Japanese yen recorded a 15-year low against the euro, while closing in on the 2022 highs at 151.95 against the US dollar.

Saloon door

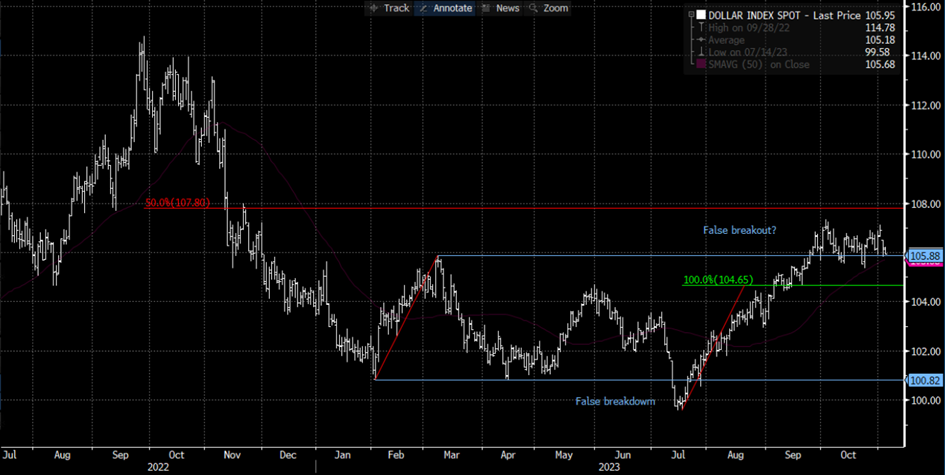

Let's take a closer look at the latter. With the probable end of the rate hike, one of the catalysts of dollar strength disappears with it. As a reminder, the dollar index has hit a major resistance zone around 107.10/80, below which it is currently consolidating flat. As long as 105.50/30 and especially 104.70 hold up, the chart structure remains bullish. But beware if this support were to be breached: it would complete a rather complex pause structure in progress since January 2023, with the corollary of a new downward momentum towards new annual lows.

Source : Bloomberg

With the dollar bending, the whole tectonic of plates is moving with it: commodity currencies are attempting a rebound, like the Aussie, which has just exceeded its 20-day moving average and the 0.6420 mark, authorizing a rebound towards the 0.6575 mark. Let's hope the Australian central bank doesn't spoil the party tomorrow. The New Zealand kiwi is also attempting a rebound above 0.5790, but we'd need to break through 0.6000 to envisage anything more serious than a simple recovery within a bearish trend. The USDSEK is stumbling below 11.18, a level which needs to be breached if it is to continue rising towards 11.47. Initial support lies at 10.87.

By

By