Sign Up for Our Free US Dollar Trading Guide Here

Talking Points:

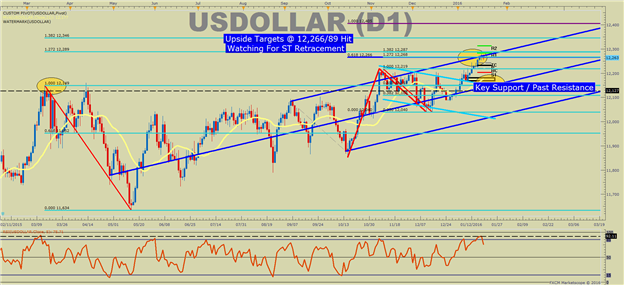

- US Dollar Technical Strategy: Stretched Momentum Favors Buying the Dip

- Multiple Upside Targets Being Hit Brings Opportunity for Pullback

- Seasonal Tendencies Continue to Favor USD Strength for January

Since December 25, US Dollar has embarked on a most impressive Bull, run toward 12-year highs. The persistent strength in the US Dollar has only been outdone by the Japanese Yen . Now, the US Dollar may become a little rich for the current price, and awaiting a pullback to reload appears to be the preferred path forward.

The current zone of resistance near 12,266/89 aligns with three separate Fibonacci Bullish targets and a price channel (blue) drawn of key closes in April-October.

Momentum via RSI (5) is showing its highest reading since the March 2015 top. While 10-month momentum peak does not mean a US Dollar top is in, momentum peaks should bring hesitancy to prudent new buyers. The good news is there is plenty of support for US Dollar Bulls to keep an eye on to re-enter on a fresh position or currently exposed Dollar Bulls to add to their already successful trade.

Bull markets and strong trends often look to past resistance as new support. On the US Dollar, the first chance for Old Resistance to turn into New Support would be ~12,220, the 2015 intraday high. Below that level, traders could look for the 2016 opening range low to act as formidable support a decent clip lower at 12,108. If that level fails to hold, a larger regime shift may be under way that would not favor US Dollar longs for the foreseeable future.

After the March peak in 2015, price retested the same level in April but failed to hold and then took 7-month to regain that level. In other words, if Momentum does not keep price afloat at multi-year highs, few things will.

To see how FXCM traders are positioned, click here.

Interested In Learning the Traits of FXCM’s Successful Traders? If So, Click Here

T.Y.

original source