Block 1: Essential news

- More and more cryptocurrency holders

In 2023, the number of cryptocurrency holders rose by 34%, from 432 million to 580 million, according to a report by Crypto.com. Naturally, this increase is largely attributed to the soaring price of bitcoin (BTC) and ether (ETH) in 2023. Bitcoin remains the most widely held cryptocurrency, with a 33% increase in the number of holders in 2023, again according to Crypto.com.

Crypto.com

- France: Towards a tax on stablecoins?

The French Court of Auditors has published a report in which it proposes taxing conversions between cryptocurrencies and stablecoins, in order to strengthen the taxation of crypto-assets. This proposal therefore suggests replacing the current taxation on the use of stablecoins for payments with a tax at the time of conversion between cryptocurrencies and stablecoins. Thus, with this proposal, the tax will no longer be calculated at the time of transfer for the purchase of a good or service, but at the time of conversion between the cryptocurrency and the stablecoin that will enable this transaction. To be continued.

- Switzerland: one step closer to tokenization

FINMA, the Swiss financial regulator, has given its approval to startup Taurus to extend its TDX platform for trading tokenized assets to retail investors, a service previously reserved for professional investors. This marks an important step towards the democratization of real asset tokenization. Taurus, in collaboration with Deutsche Bank, is promoting easier access to tokenized assets, including fungible and non-fungible tokens (NFTs). This breakthrough reinforces Switzerland's position as Europe's leading innovator in the cryptocurrency and tokenization sector.

- Binance boss forced to stay in the USA?

Changpeng Zhao, the ex-CEO of Binance, stuck in the US for a trial, tried to return to the UAE by tying up $4.5 billion of his Binance shares as bail to visit a sick relative. His request was denied despite the bail offered. He is currently free in the USA on $175 million bail, awaiting his verdict on February 23 for money laundering, facing 18 months in prison and having already paid a $50 million fine.

Block 2: Crypto Analysis of the weekThe bitcoin price has fallen 15% since the approval of bitcoin cash exchange-traded funds (ETFs).

MarketScreener

The euphoria that reigned in the crypto-sphere, and even beyond its borders, prior to the approval of ETFs has thus calmed down drastically. The main reason for the BTC price collapse is the sale of Grayscale's GBTC shares.

Specifically, Bloomberg's Katie Greifeld reports a significant outflow of over $3.4 billion in just over a week.

Bloomberg

Before being converted into a cash ETF on January 11, GBTC (Grayscale Bitcoin Trust) was a closed-end trust. The free float increased only in restricted windows when institutions received shares in exchange for bitcoins.

As a reminder, "free float" in the context of GBTC refers to the number of shares available for trading on the open market. More specifically, for funds like GBTC, free float represents the number of shares that are not held by long-term investors or insiders, and are therefore freely tradable on the market. This means that the number of shares outstanding (the free float) only increased during specific periods. These periods were the windows during which institutions could exchange bitcoins for fund shares. Outside these windows, the free float remained fixed, and no new shares were created.

Obviously, a higher free float generally means greater liquidity, enabling shares to be bought and sold more easily on the market.

For the first six years of its existence, the GBTC traded at a premium to net asset value. Just to clarify, the "premium" in the context of products like the GBTC, refers to the difference between the market price of the asset and its intrinsic value or net asset value (NAV).

In simple terms, if a fund like GBTC is trading at a "premium", this means that its market price is higher than the actual value of the underlying assets it holds. For example, if GBTC holds bitcoins with a total value of $100 million, but the market value of GBTC is $110 million, then it trades at a 10% premium.

Conversely, a fund trades at a "discount" when its market price is lower than its net asset value. This can happen for a variety of reasons, such as concerns about the fund's management, liquidity restrictions or changes in investor demand.

In the case of GBTC, it has historically traded at a premium to the net asset value of its underlying bitcoins, meaning that investors were willing to pay more than the actual value of the bitcoins held by GBTC to benefit from exposure to bitcoin via a traditional investment instrument. But over the course of 2022, GBTC traded at a 48% discount before beginning to recover to par when it was converted to an ETF on January 11.

Bloomberg

To make matters worse, according to media outlet CoinDesk, the team in charge of FTX's bankruptcy sold a very large number of GBTCs: 22 million in all, or around $1 billion. The bankrupt exchange has thus disposed of its positions in the newly converted Grayscale Bitcoin Trust ETF, and these exits are intended to be used to repay creditors rather than recycled into competing Bitcoin ETFs with lower fees.

Even so, even with the massive GBTC sell-off, there was a net inflow of over $1 billion into these cash-based Bitcoin ETFs.

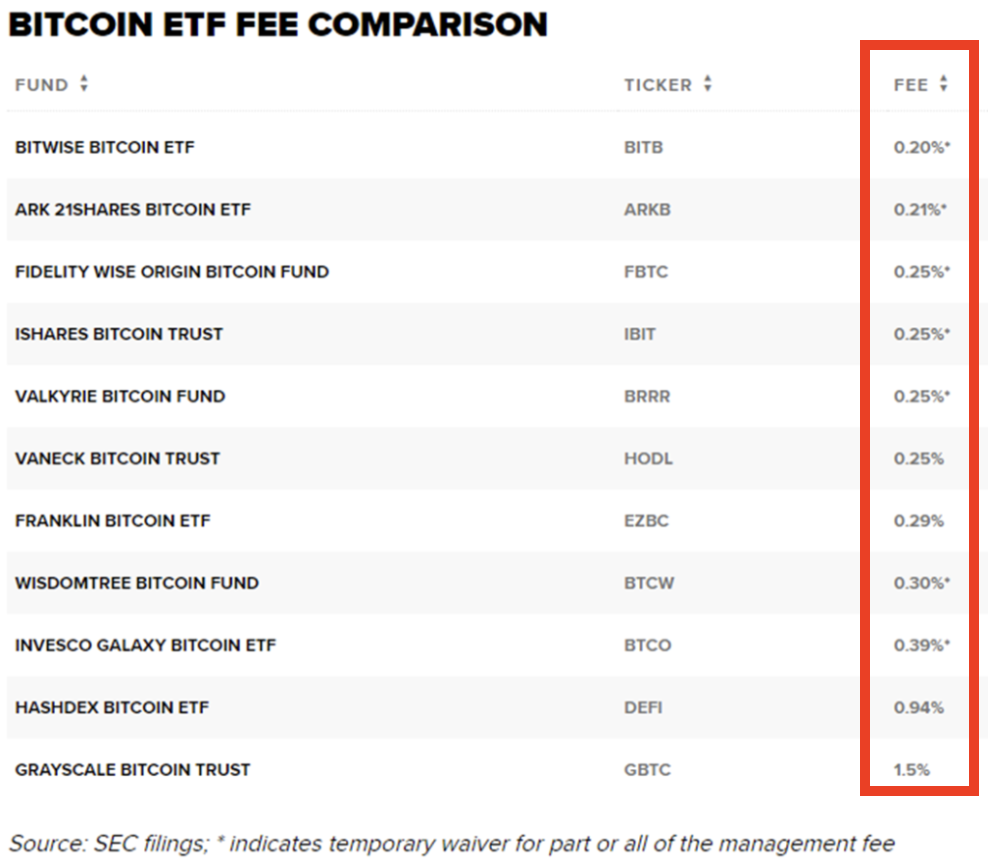

The icing on the cake is that, when it comes to management fees, GBTC doesn't have what it takes to attract new crypto-investors. Most of the eleven ETFs have extremely low fees, with the exception of GBTC, which has lowered its management fee from 2.0% to 1.5%.

SEC

In the end, many investors are taking advantage of this situation to take profits on GBTC, while some are transferring their funds to ETFs with lower management fees.

For its part, Coinbase appears to be a big winner from this ETF launch, as the bitcoin custodian of eight of the funds. But Fidelity provides its own custody, VanEck uses Gemini and Hashdex uses BitGo.

Two other factors may explain bitcoin's wobble, including the old stock market adage "buy the rumor, sell the news", as well as some of the macroeconomic suspects like the rise of the US dollar in recent days, which is historically negatively correlated with bitcoin's evolution.

Thus, earlier predictions that the introduction of ETFs would propel bitcoin to unprecedented levels, reaching as high as $100,000, appear to have been buried for the time being.

To end on a positive note, despite the friction on bitcoin's price, the network remains intact. The network's hash rate is on an all-time high, Bitcoin's software is working exactly as expected, producing block after block of transactions. And all in all, thanks to these 11 ETFs, more people have access to buying bitcoins today than two weeks ago.

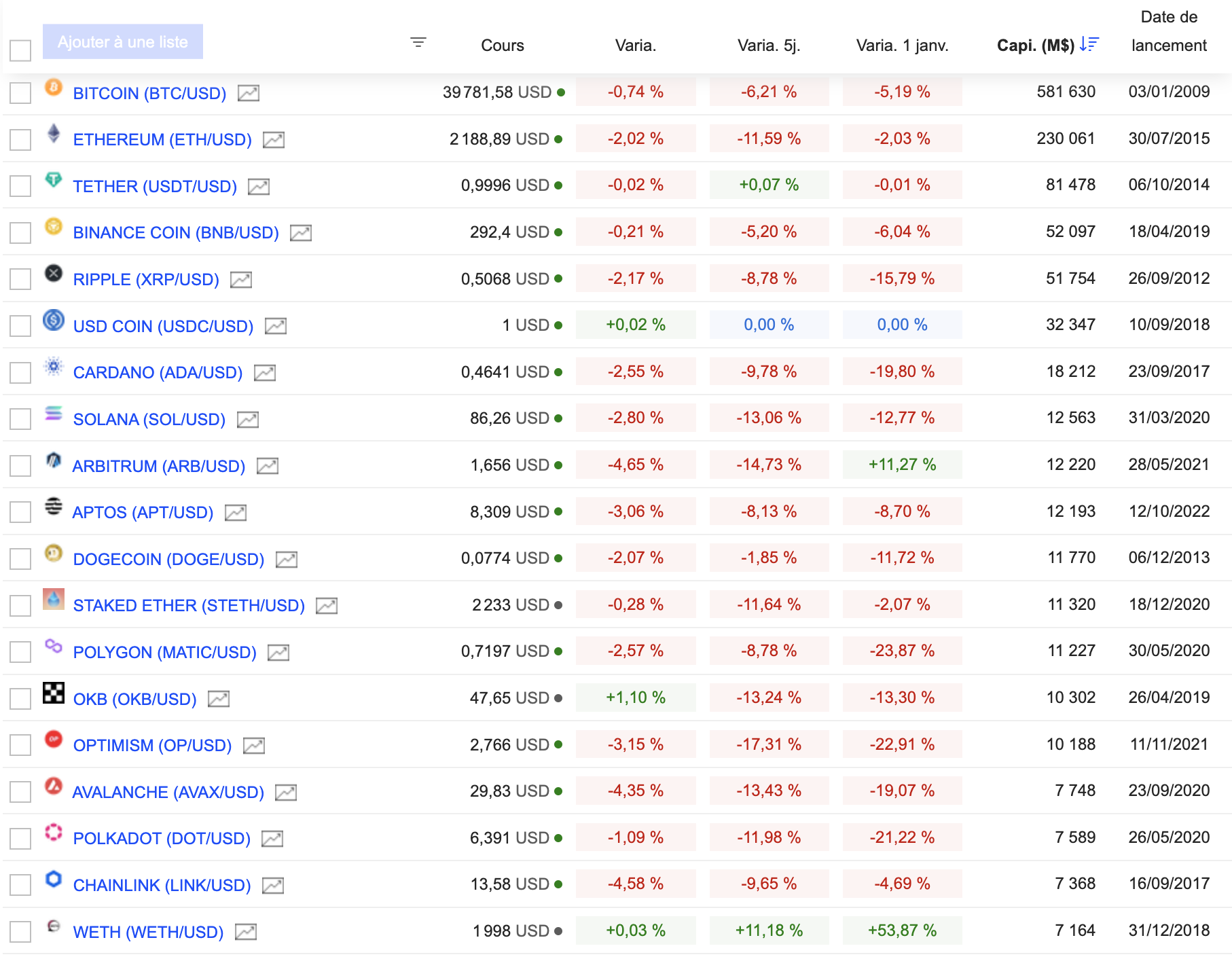

Block 3: Gainers & Losers

Cryptocurrency chart(Click to enlarge)

Block 4 : A few things to read

Bitwise becomes first Bitcoin ETF to disclose BTC holding addresses (Bitcoin Magazine)

If bitcoin ETFs are so great, why is bitcoin falling? (FT Alphaville)

By

By