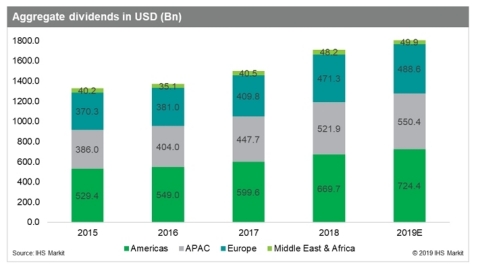

Total dividend payouts are expected to reach a record $1.81 trillion in 2019, an increase of 6.0 percent, according to a new report from business information provider IHS Markit (Nasdaq: INFO). This represents a significant decrease in the rates of growth demonstrated in the past two years, when payouts jumped by 9.4 percent in 2017 and 14.3 percent in 2018.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190117005073/en/

Aggregate dividends in USD (Source: IHS Markit)

“Our relatively conservative outlook, which draws on a bottom-up analysis of more than 9,500 firms, echoes the backdrop of increasing uncertainties caused by trade and geopolitical tensions,” said Thomas Matheson, head of dividend research at IHS Markit. “The confluence of these factors is prompting some companies to revise their forward guidance lower, suggesting that management teams are downbeat on short-term prospects. This is particularly apparent in export-oriented economies like Japan, where we expect dividend growth of less than 5 percent after several years of double-digit growth.”

All regions are set for a deceleration in dividend growth. In Europe, four of the top five dividend-paying countries are projected to moderate their increase in dividends: The United Kingdom, France, Germany and Russia. In Asia-Pacific, strong dividend growth from China and Hong Kong will be offset by decreasing dividends from India, Indonesia and Taiwan. While the United States is expected to generate healthy growth of 8.1 percent in 2019, this is still lower than the expansion exhibited over the past two years.

On a sector basis, the Dividend Forecasting report predicts that the banking sector is expected to remain the top dividend payer, with payouts forecast to be $288.22 billion, up from $270.26 billion last year. Banks in the U.S. are predicted to lead growth (16.1 percent), followed by European banks (5.8 percent) and Asian banks (4.2 percent).

Emerging markets have outperformed developed markets in dividend growth over the past two years, with this momentum set to continue into 2019. Payouts from emerging markets account for around one-fifth of the dividends estimated for 2019 and are projected to grow by 6.1 percent to $369.94 billion, supported by higher dividends from state-owned enterprises in China, Brazil and Russia.

Amid the dull outlook, one bright spot is the oil and gas sector, which will register one of the highest growth rates in dividends among all other sectors in the coming year. Following the rebound in oil prices over the last two years, payouts from energy companies will account for approximately 10 percent of global dividends, with ordinary dividends expected to reach $187.9 billion in 2019, up 9.0 percent from the previous year.

The report also reveals:

- China dividends growth will decelerate but remain very strong hitting a double-digit growth rate for the second consecutive year.

- Trade tensions are expected to weigh on dividends from various automotive companies.

- In terms of dividend growth, banks listed in the UK are expected to outperform banks in the Eurozone, despite political uncertainty surrounding Brexit.

- For the second consecutive year, the telecommunications sector continues to be the most vulnerable to dividend cuts, amid stronger competition and weaker fundamentals.

For the full 2019 Dividend Forecasting report, please contact Katherine Smith. Click here for more information on IHS Markit Dividend Forecasting.

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and product names may be trademarks of their respective owners © 2019 IHS Markit Ltd. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190117005073/en/