|

Monday September 16 | Weekly market update |

| The willingness of China and the United States to reach a future agreement (with the postponement or the exemption of import taxes) has allowed the major indices to continue their mad rise this week. Investors also unanimously welcomed the ECB's new support measures, and it will now be up to the Fed to reassure the markets next week. The Fed's decision will undoubtedly have its consequences, as the financial markets are evolving at record levels. |

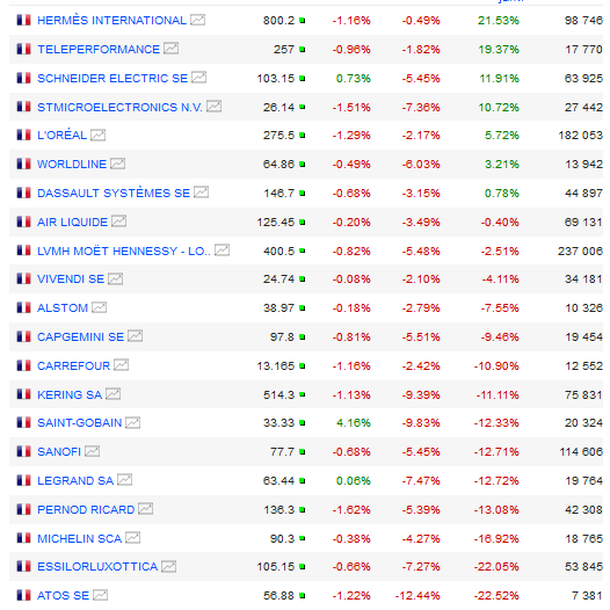

| Indexes In Europe, the Dax rose by 2.3% and the Footsie by 1.1%. The French CAC40 is on track to close at a level not seen since the end of 2007, with a weekly performance of 1% (see chart). In the peripheral countries of the euro zone, Portugal gained 1.8%, Spain 1.5% and Italy 0.9%. In Asia, the Nikkei reaped 3.7%, the Hang Seng finished in the green for the second week in a row, with a gain of 2.5% and the Shanghai Composite won 1% (its fifth consecutive week of growth and a monthly performance of 5%). In the United States, at the time of writing and pending next week's Fed decision, the Dow Jones is up 1.6%, the S&P500 1.2% and the Nasdaq100 gains 0.7%, all three indices flirting with their all-time records. CAC40 graph in weekly data since the end of 2007  |

| Commodities Caught between the easing of Sino-American trade tensions and Washington's change of tone towards Tehran, the oil prices have stagnated this week. More specifically, an improvement in trade relations between the two economic giants would a priori be beneficial for the world economy and therefore for the oil demand, while a reduction in US sanctions against Iran would still mean an increase in international supply. Market operators therefore navigate carefully and adopt a wait-and-see attitude. The price of a barrel of Brent hovers around 60 USD while the WTI stands still at 55 USD. On the precious metals side, the accommodating policy from the European Central Bank is pushing up the gold price, which is trading around USD 1500 per ounce. Silver hasn't changed much and is still trading at last week's levels around 18.15 USD. The "hard" commodities segment is evolving in positive territory. While the nickel price continues to advance beyond USD 18,000, tin, copper and zinc rebound to respectively USD 17460, 5840 and 2360. |

| Equities markets Copart: an American beauty Copart is an American company founded in 1982 and based in California. The company is listed on the Nasdaq since 1994 and positioned in a particular niche that it completely dominates: the recovery, storage and sale, directly or via an auction system, of damaged or abandoned vehicles. However, the company's business activity remains capital-intensive because it must have many warehouses (around 200 in North America) and it intends to expand widely in Europe. The stock, due to its fundamental qualities, has been included in the MarketScreener USA portfolio. The company's performance is meant to be qualitative. Over the past ten years, the share has gained more than 780%, 69% of which since the beginning of January. Strong growth of the Copart shares over the past 10 years  |

| Bond market The week was characterized by an increase in yields. The German Bund recovered beyond -0.50% and the French OAT at -0.20%. Symbolically, the German 30-year bond even went back into positive territory (+0.06%). We saw the largest jump in Swiss debt, which is traded on a basis of -0.75%, i.e. an increase of 25 basis points. The spreads are narrowing against the Southern European benchmarks. The Spanish 10-year rate stabilizes at 0.27% and the Italian one at 0.90%. On the US side, the Treasury notes on the standard maturity are under a slight tension at 1.80% (+20 basis points over one week). This movement is supported by the possibility of a provisional US-China agreement and by the relatively low demand generated by a 30-year Treasury bond auction. |

| Forex market Following the ECB meeting, the euro moved up and down before stabilizing at 1.11 USD. The week was also marked by a sharp easing in safe-haven currencies. Forex traders are taking gains on the yen and the Swiss franc, the main winners of these past few months of trade tensions. The yen lost more than 300 basis points from its high against the euro and traded around JPY 120. The Japanese currency shows the same trajectory against the dollar, losing ground at JPY 108. In the United Kingdom, the pound sterling is recovering, gaining 1.5% against the US dollar at 1.24 as well as against the euro at 0.895. The decline in safe haven currencies is often accompanied by an improvement in secondary currencies. Thus, the Brazilian real recovered against the greenback at 4.06 BRL and the Indian rupee reacted in the same way at 71 INR. These recovery movements are consistent with the recovery of the Chinese renminbi. Finally, it is worth noting the strong rise in the Australian dollar, which gains 280 basis points against the Japanese currency (JPY 74.20) and 180 points against the greenback (USD 0.69). |

| Economic data Mario Draghi didn't disappoint. At his penultimate ECB meeting, the President of the central bank confirmed all of the market's expectations. He decided to relaunch the Quantitative Easing program, with monthly asset purchases of €20 billion starting in November. This unconventional measure can be considered as a positive surprise and a strong "pledge". In addition, the deposit rate was reduced by 10 basis points (to -0.5%) and a two-tier system of remuneration on reserves was introduced to relieve commercial banks. Last but not least, the future direction of key rates has been broadened. Now it is the FED's turn to intervene this coming Wednesday, with strong market expectations for a rate cut of 25 basis points that is justified, as for its European counterpart, by increasing international risks. Stoxx Europe 600 Banks Index  |

| The market waited and wasn't disappointed Expectations were high since the recovery of the European indices at the end of August. For his before last meeting as President of the ECB, Mario Draghi provided us with a whole arsenal of tools able to comfort investors. At the same time, risky assets also benefit from reassuring news coming from the trade dispute. The window of opportunity is therefore quite good for managers who are intensifying their equity allocations. The sector rotation strongly works in favour of the automotive and banking segments, which are regaining ground after a long period of underperformance. Will this trend continue? The Fed's upcoming announcements, under pressure from Trump, who is demanding negative rates, and the announcements of the Bank of England, in an inextricable Brexit, will have to provide further positive signs for a market... that wants more and more. |

By

By