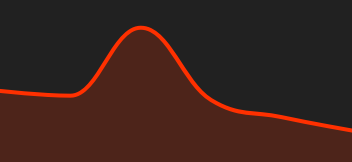

- Atmosphere: March is not happening. The week that has just ended has enabled us to fine-tune bets on rate cuts by the main central banks, all without doing much damage to the equity markets. However, the Fed Chairman almost explicitly ruled out a rate cut in March, which remained the market's dominant assumption. The impressive US employment figures for January, published on Friday, only reinforced this sentiment. The US economy is so strong that the Federal Reserve has little interest in cutting rates, at the risk of seeing activity surge again, which would probably lead to a resurgence in inflation. The probability of monetary easing as early as the March meeting has fallen to 17%, compared with 70% a month ago. This situation put an abrupt end to the bond rally, driving yields on two-year, five-year and ten-year debt up by 10 to 20 basis points. Faced with this situation, US equity markets remained stoic, as if investors believed that the US economy was in no danger, even if the start of the rate-cutting cycle was delayed. In Europe, inflation moderated in France, but rose slightly more than expected in Germany and Spain, which did little to alter expectations regarding the ECB, even though growth figures for the main European economies came out rather weak. In China, Beijing's initiatives to revive the financial machine were not crowned with success, owing to the ongoing real estate debacle.

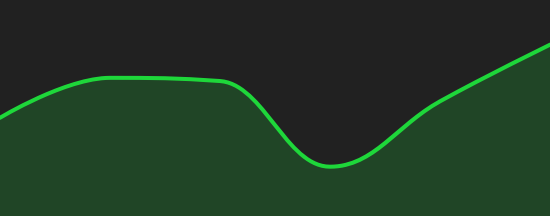

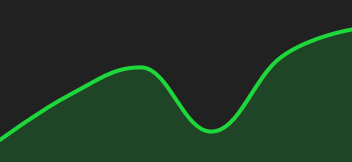

- Crypto: The price of bitcoin rose slightly this week, back above the $42,600 mark, up +1.60% since Monday. Ether followed the same trend, up +1.25% and closing in on $2,300. After peaking at $49,000 on January 11, the date of the launch of Bitcoin Spot ETFs in the US, bitcoin has run out of steam and is now struggling to reach new heights. On the other hand, bitcoin did record five consecutive months of gains, between September 2023 and January 2024, taking its price from $25,930 to over $42,500. This is only the fourth time that BTC has achieved such a performance in its short existence.

|

By

By