To ensure the integrity, robustness and efficiency of the network, miners rely on the blockchain technology and the algorithmic protocol Proof-of-Work (PoW) of Bitcoin. This contribution helps to maintain the network and ensure the transactions carried out on it. As the code states, these miners are rewarded for performing these tasks, and as you can imagine, some have dedicated their professional activity to it. The miners' income depends on the hash rate of their hardware. Behind this concept is the miner's performance factor. To put it simply, the "hashrate" measures the mining power of a computer equipment per second. It is the speed of mining. The measure is the unit of hash/ per second, how many complex calculations per second can be executed.

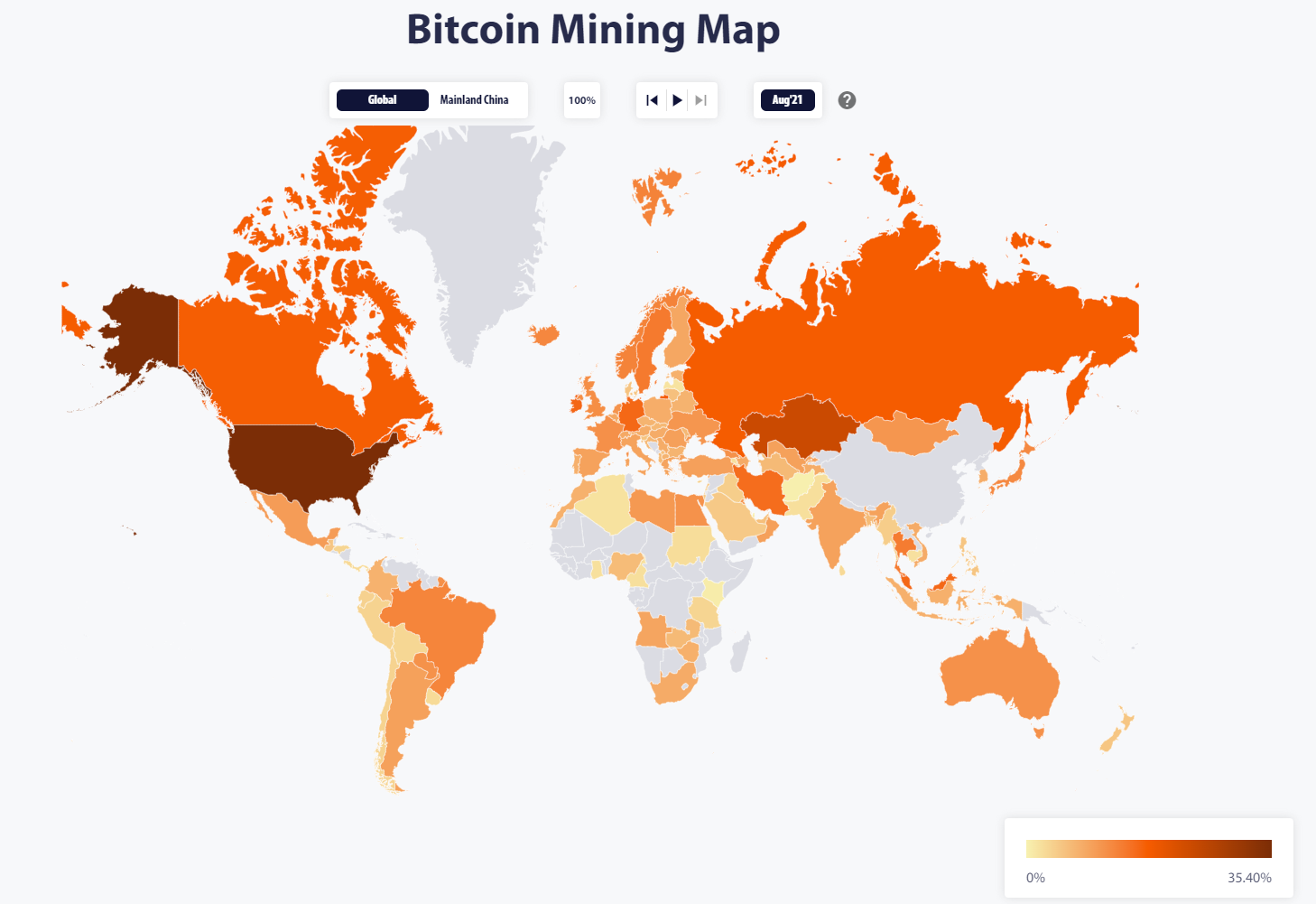

Bitcoin hash rate by country in the world

Source: University of Cambridge

China's mining power is fading due to stricter regulation, and the United States has positioned itself as the leader in global hash rate. China has banned all financial institutions, payment companies and internet platforms from trading cryptocurrencies, arguing that it disrupts the economic and financial order. As the central bank digital currency "e-yuan" is democratized in the country, some see it as a way to eliminate competition. The US already attracted many mining farms and they had to strategically choose their state of installation according to the cost of electricity in each state.

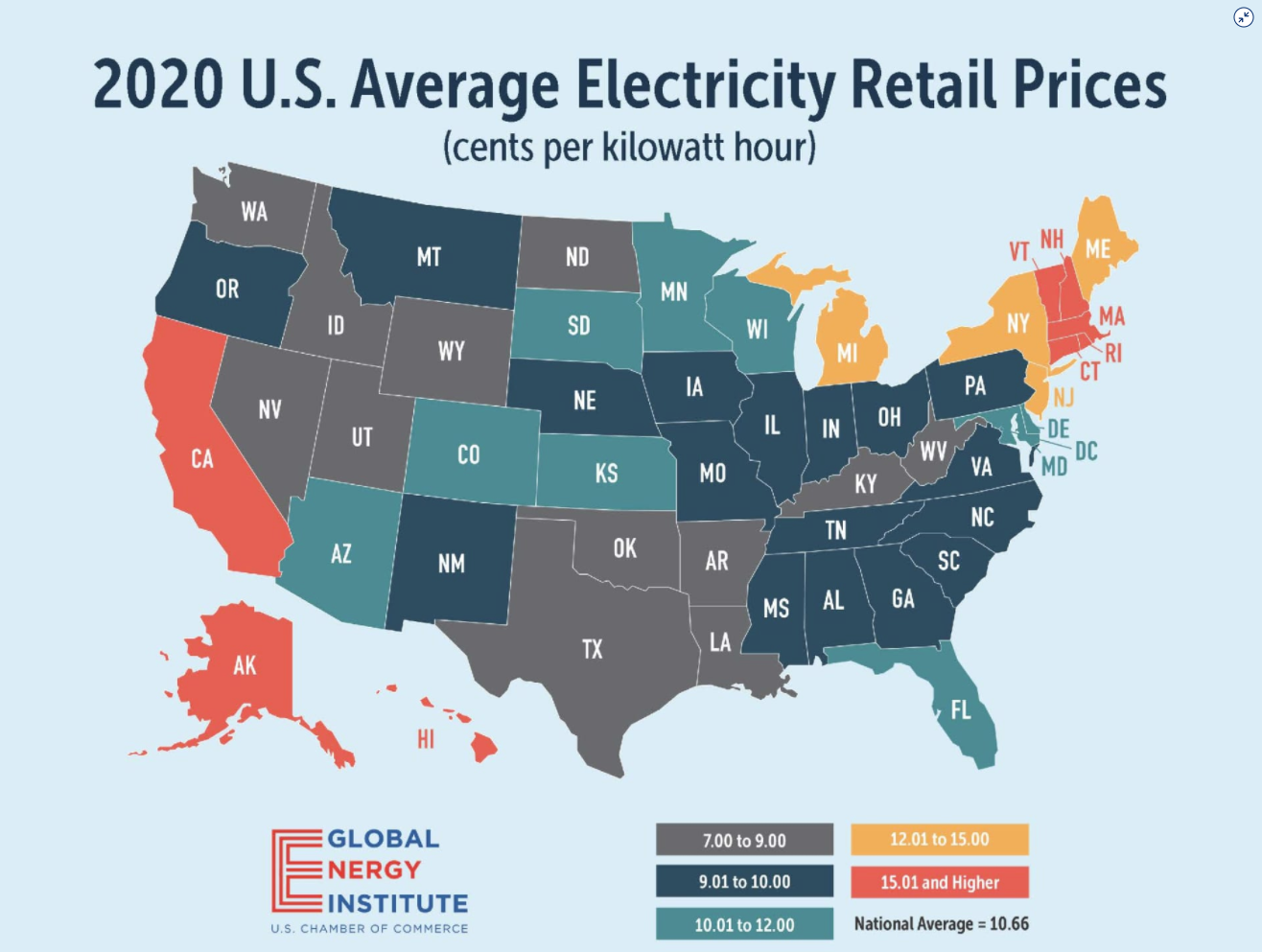

Cost of electricity in each state in the US.

Source: CNBC

Let's put ourselves in the shoes of a mining company: the most streamlined mining operations are those that contain the most advanced computer equipment while benefiting from low electricity costs. Our profits will depend on the balance between the costs of operating the mining platforms and our computing power (hashrate). Quick and simplified calculation:

Earnings = Hashrate - (hardware cost + taxes + electricity cost + infrastructure cost)

As I write this, the global hashrate of the Bitcoin network is around 160 million Th/s (Tera hashes per second).

Total Hashrate (Th/s) of the Bitcoin network

Source: Blockchain.com

Bitcoin mining companies express their computing power in exahash (EH/s). To give you an idea:

1 kH/s is 1,000 hashes per second; 1 MH/s is 1,000,000 hashes per second; 1 GH/s is 1,000,000,000 hashes per second; 1 TH/s is 1,000,000,000,000 hashes per second; 1 PH/s is 1,000,000,000,000,000 hashes per second; 1 EH/s is 1,000,000,000,000,000 hashes per second

After this relatively long but necessary introduction, let's move on to our two crypto-mining stocks.

Marathon Digital Holdings (NASDAQ: MARA)

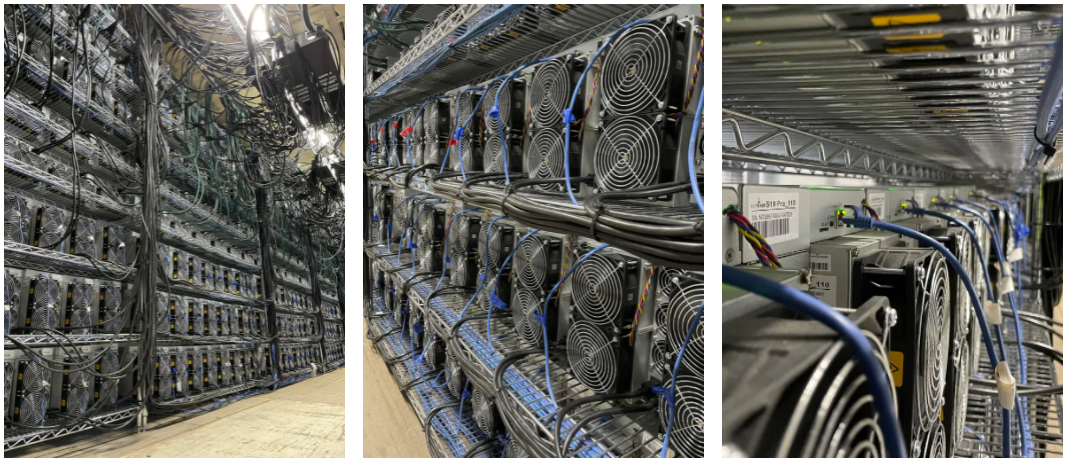

Marathon Digital Holdings, formerly Marathon Patent Group, Inc, is a company that operates in the blockchain segment and more specifically the mining of digital currencies, in this case Bitcoin. The company operates a data center in Hardin, Montana, United States, with an energy capacity of about 105 megawatts. This allows it to harness electricity at a production cost of only: $0.028/kWh. As an example, the production of bitcoins in October was 471.7 which brings the number of bitcoins held by the company to almost 7500. At the current price, the market value is therefore $450 million worth of bitcoins. The current mining fleet consists of 27,280 pieces of mining equipment. Orders are being placed with equipment supplier Bitmain to increase the capacity of the fleet, and based on current estimates, and these plan to swell the fleet to 130,000 miners during 2022.

Data center in Hardin

Source: marathondh.com

The year 2020 has not been particularly good for Marathon with more losses than gains, and based on the various qualitative fundamentals, the company appears to be in the black. Based on the various fundamental qualitative criteria, it appears particularly risky from a medium and long-term investment perspective. Indeed, it is totally dependent on the future of the cryptocurrencies market and therefore on all the political-macroeconomic factors that this implies. For its part, growth forecasts are on the rise based on current estimates, however, caution is advised while waiting for an international regulatory framework related to digital assets. Early adopters can still take a chance on this type of investment.

Features of Marathon Digital Holdings

Current hash rate in EH/s: 2.96

Expected hash rate in 2022 in EH/s: 13.3

Market capitalization: $5,645 billion

Country: USA

Marathon Digital Holdings (MARA) share price

Source: MarketScreener

Riot Blockchain (NASDAQ: RIOT)

Riot Blockchain Inc, formerly Bioptix, Inc, focuses on exposure to the blockchain ecosystem through its mining operations, internally developed businesses, joint ventures and targeted investments in the sector. In May 2021, the company announced the acquisition of Whinstone U.S (based in Texas), the owner-operator of North America's largest bitcoin mining and hosting facility to expand its mining operations.

Whinstone U.S. mining site

Source: riotblockchain.com

For now, Riot is operating out of Coinmint LLC. in Massena, New York, where a fleet of more than 16,000 Bitcoin mining equipment are installed. Coinmint offers a very low cost of electricity, allowing Riot to benefit from a kWh at $0.025 per unit. For the month of September, the company mined 406 bitcoins which brings the total number of coins held by the company to 3546 BTC, which at the current price is a market value of $213 million. The current orders announced publicly, would increase the number of mining tools to the number of 81 150 by the end of 2022.

On the financial side, Standard & Poor's consensus revenue estimates related to Riot Blockchain, are among the best growth cases. The earnings growth currently expected by analysts for the coming years is particularly solid and the company's margins are among the highest on the stock market. The company's business has been particularly profitable in recent months. Over the past 12 months, future revenue expectations have been revised upwards many times, but the company is trading on high earnings multiples: 57.66 times its estimated earnings per share for the current year. As with Marathon Digital, Riot is almost entirely exposed to Bitcoin's evolution, so caution is warranted until a clear regulatory framework is in place.

Features of Riot Blockchain

Current hash rate in EH/s: 1.16

Expected hash rate in 2022 in EH/s: 7.7

Market capitalization: $3,541 billion

Country: US

Riot Blockchain (RIOT) share price

Source: MarketScreener

If I have awakened your mining soul, you will have understood that behemoths are in place to grab satoshis every second that this world does. If you want to try your luck, as we've seen, you'll have to consider several factors, such as the cost of hardware, the cost of electricity, and the cost and ability of your computer hardware to solve complex calculations. Here, we have focused on Bitcoin mining via the Proof-of-Work protocol, but other algorithmic consensuses exist and allow for different mining models, such as Proof-of-Stake. I'll be writing an article on this topic soon in the MarketScreener columns.

By

By