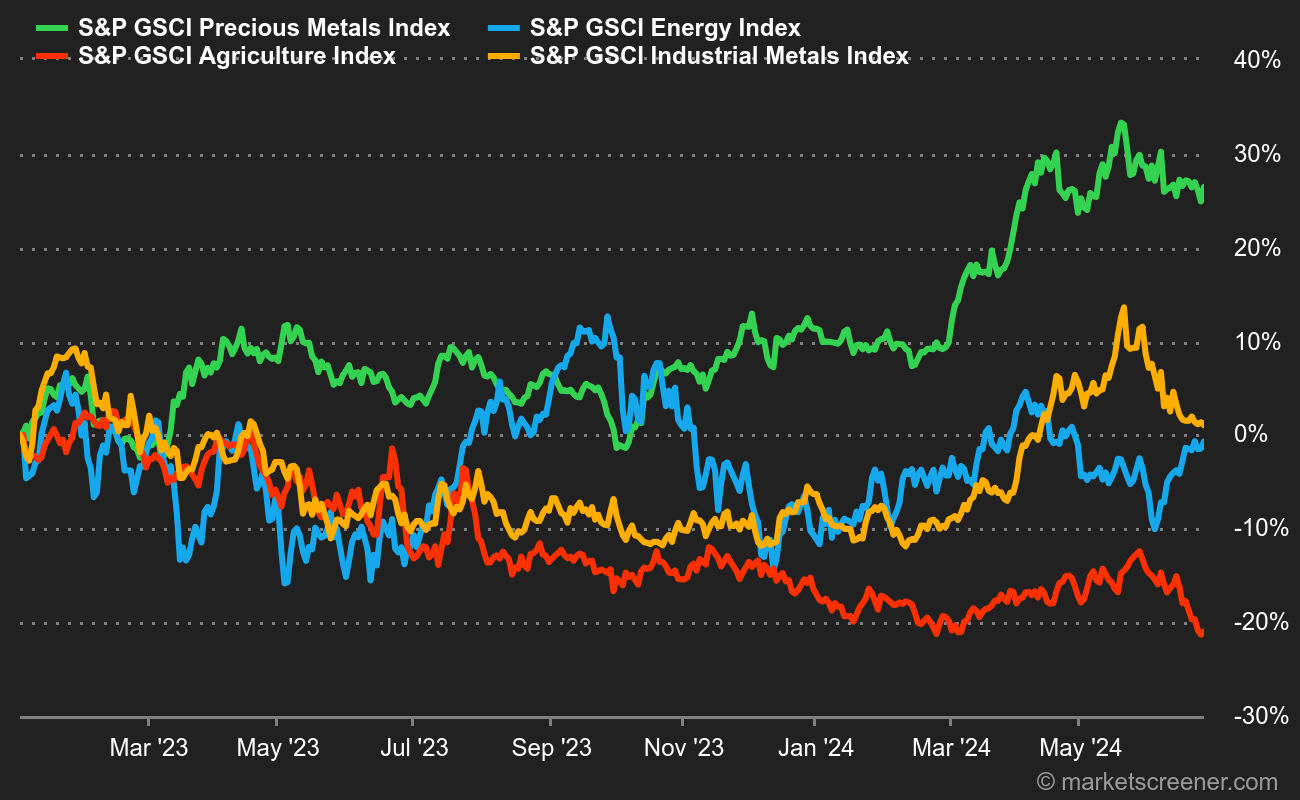

Energy: Oil prices are catching their breath despite positive global data, notably the slowdown in US inflation, and very optimistic forecasts issued by OPEC. The cartel is forecasting demand growth of 2.25 million barrels per day (mbpd) this year, and 1.85 mbpd in 2025. These figures are far more optimistic than those of the International Energy Agency, which is counting on growth of 960,000 barrels per day in 2024 and 1 mbpd in 2025. This divergence of views underlines the prevailing uncertainty and, above all, the difficulty of predicting energy market movements with any precision. China has nonetheless thrown a spanner in the works, rekindling concerns about the dynamics of its domestic demand. The latest trade data are mixed, with Chinese oil imports contracting by around 10% year-on-year. On the price front, Brent is trading at around USD 85, while WTI is trading at around USD 80.70.

Metals: It's a tale of two dynamics between industrial metals, which retreated last week, and precious metals, driven higher by gold's form. In base metals, copper retreated in London to USD 9780 (cash price), weighed down by rising inventories in LME warehouses. Gold, on the other hand, celebrated the fall in US inflation, which reinforces the likelihood of a Fed rate cut in the near future. The barbarian relic is thus trading above USD 2400 an ounce.

Agricultural products: Despite a rebound at the end of last week, grain prices are still trending downwards in Chicago. A bushel of wheat is trading at 534 cents (due September 2024), while corn is holding steady at 410 cents (also due September 2024).

By

By