|

|

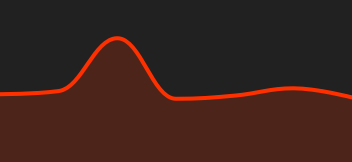

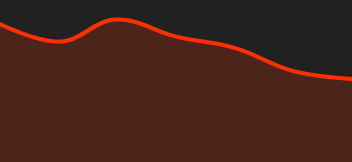

| This week's gainers and losers |

| TOPS: Alnylam Pharmaceuticals +46.65%: The Massachusetts-based biotechnology company announced positive preliminary results from a phase 3 study on Vutrisiran, a therapy for treating ATTR amyloidosis with cardiomyopathy, a rare heart disease. Rivian +30.04%: On Wednesday, the electric vehicle manufacturer soared after Volkswagen announced a $5 billion investment. This fresh capital will greatly benefit the unprofitable startup, enabling it to increase production in a slowing market dominated by Tesla. Rivian will also be able to bolster its cash reserves and reduce the cost per vehicle to become more competitive against Chinese manufacturers. Bank of America praised this investment. Fedex +18.21%: The delivery giant surprised the market with annual results exceeding expectations and positive outlooks for the new fiscal year. Sales did fall to $87.7 billion from $90.1 billion last year, but profitability improved. Profits rose to $4.3 billion. The company now expects single-digit revenue growth. Additionally, adjusted earnings excluding costs related to business optimization initiatives are projected to be between $20 and $22 per share. DS Smith +16.49%: The British packaging specialist was in a bidding war with Brazilian company Suzano to acquire International Paper. Suzano has withdrawn from the race as it could not find common ground under private, confidential, and friendly terms. Consequently, the initially planned merger between DS Smith and International Paper is expected to proceed under favorable conditions. Carnival +16.49%: The world's largest cruise operator has raised its full-year expectations after posting an unexpected profit in the second quarter. For the full fiscal year, adjusted earnings are now expected to be $1.18 per share, up from the previous estimate of $0.98. The company notes strong demand—with an occupancy rate of 104%—and a market environment that should allow it to achieve double-digit returns on invested capital. Walgreens Boots Alliance -24.26%: The American pharmacy chain posted the largest drop in the S&P 500 following the release of its third-quarter results. Despite a 2.6% increase in revenue, earnings per share came in at $0.63, down 36% year-on-year, versus a consensus of $0.71. Additionally, the company announced the closure of a quarter of its stores and lowered its 2024 earnings per share target to a range of $2.80 to $2.95, from a previous $3.20 to $3.35. The company cited headwinds from a decrease in American consumer spending, which is weakening the entire pharmaceutical sector. Elanco Animal Health Incorporated -20.06%: Shares of the American pharmaceutical company specializing in animal health plummeted. The company reported that Zenrelia, its treatment for canine dermatitis, would launch with a warning label. Elanco expects a completion letter in July, followed by a final administrative review of 60 days, pushing the final approval from the U.S. Food and Drug Administration (FDA) to the third quarter. The warning label will limit the dosage for unvaccinated dogs, potentially slowing its initial adoption and reducing the number of treatments by about 25%. Levi Strauss & Co -16.21%: The American jeans and casual wear manufacturer reported quarterly results below expectations on Wednesday. Revenue, up 8% to $1.40 billion, missed the market consensus of $1.45 billion. Additionally, the company is forecasting a modest 1% to 3% increase in net revenue for the current fiscal year, a cautious outlook that has dampened market enthusiasm. TD Synnex -11.21%: Shares of the American IT solutions aggregator and distributor dropped this week. The company reported second-quarter results below expectations, with non-GAAP earnings of $2.73 per diluted share, compared to analysts’ expectations of $2.82. Moderna -10.98%: Shares of the American biotechnology company declined sharply. A report from the Centers for Disease Control and Prevention (CDC) indicated a lack of efficacy for its "mRESVIA" respiratory syncytial virus vaccine, compared to those of its rivals. JD.com -8.04%: The Chinese online retail giant experienced mixed sales during the major Chinese e-commerce festival, compared to the previous year. The economic slowdown in China has instilled a sense of caution among consumers. JD.com, along with all its Chinese e-commerce peers listed on Wall Street, tumbled. Micron -5.74%: The American semiconductor giant plummeted after announcing disappointing revenue forecasts, dragging down the entire chip sector. Investor sentiment was also affected by uncertainties surrounding upcoming economic data and the presidential debate. Merck KGaA -7.20%: The pharmaceutical group’s share price dropped following the announcement of the discontinuation of phase III clinical trials for Xevinapant. This drug for treating head and neck cancers had raised high expectations for the company’s future, especially after the failure of Evobrutinib, a drug for treating multiple sclerosis. Citigroup had estimated potential sales of Xevinapant at €1.4 billion. This announcement increases concerns about the company’s ability to renew its product pipeline. |

|

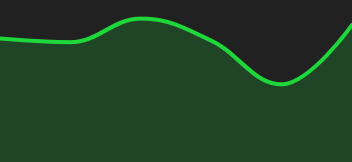

| Commodities |

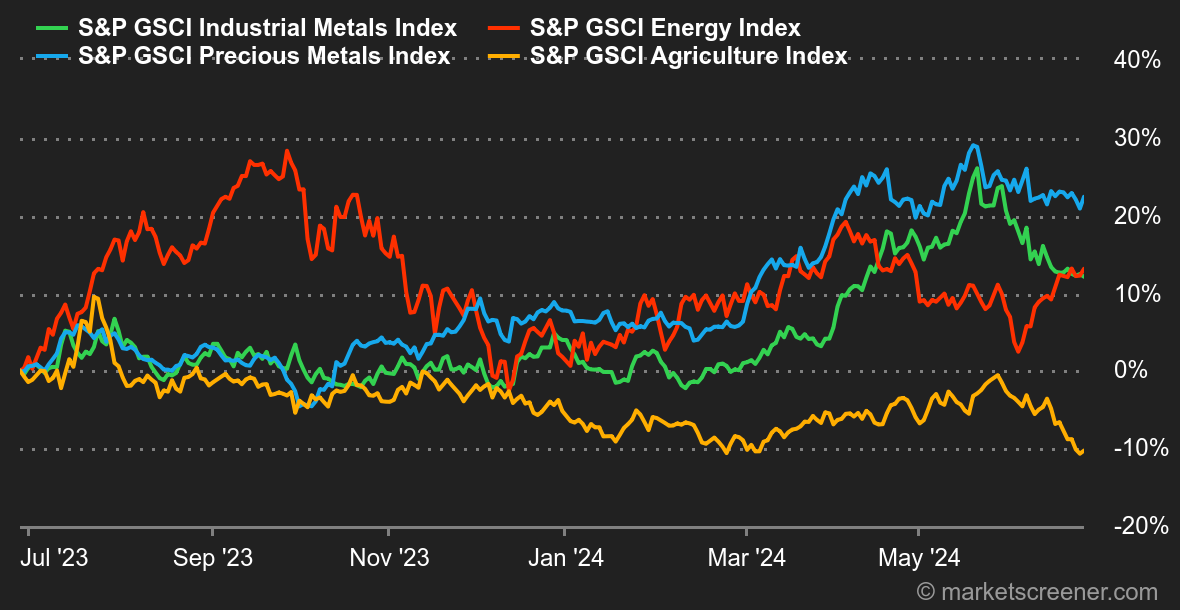

Energy: Oil prices continue to rise. Geopolitical tensions remain high in the Middle East, where observers fear the war could spread to Lebanon. In response, several countries, including Germany, have urged their citizens to leave the country. These frictions are supporting crude oil prices, overshadowing the dynamics of US stockpiles, which increased by 3.6 million barrels at Cushing, contrary to expectations of a decrease. The rise in stockpiles is partly explained by the decline in US exports, while American refinery activity is tending to contract, a rather worrying sign about the state of US demand for refined products. In terms of prices, Brent is trading up around $85.5, while WTI is around $81.80. Metals: Copper continues its decline on the London Metal Exchange, trading close to $9,515 for its cash price. The rise in the dollar and the absence of bullish catalysts weigh on the entire industrial metals segment. Also in London, aluminum is slowly slipping towards $2,490. Gold, meanwhile, is holding steady around $2,355. Agricultural Products: Cocoa prices are correcting dramatically, with a 15% drop this week. Improved weather conditions in Ghana and Cameroon are easing concerns about a global supply deficit. However, it’s worth noting that cocoa prices are still up 80% since January 1st. |

|

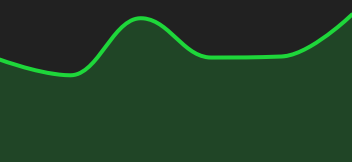

| Macroeconomics |

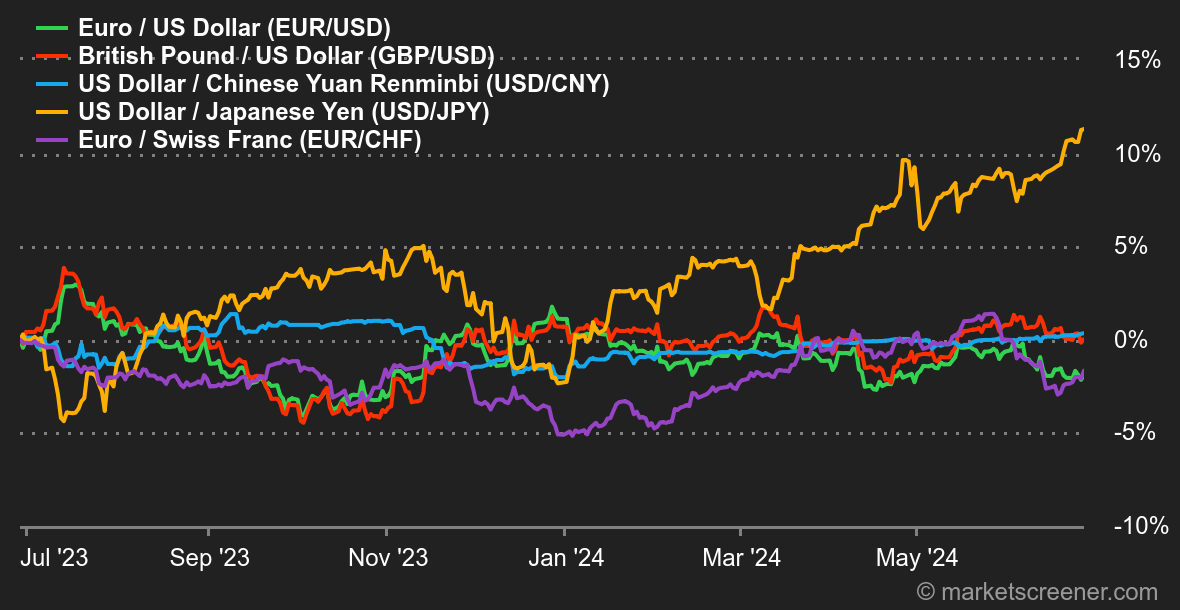

Atmosphere: Tensions rise ahead of the elections. The situation in France continues to intensify two days before the first round of legislative elections. Evidently, investors are reluctant to be exposed to the Paris stock market, driving up the risk premium on the bond market. Consequently, the yield spread between German and French 10-year bonds is nearing our target of 86 basis points, with a significant risk of climbing to 112 depending on the election outcome. If this happens, the CAC40 is likely to take another hit. On the Anglo-Saxon front, while the UK elections seem set to oust the current Prime Minister, a drama unfolded across the Atlantic. The first 2024 US presidential debate between Joe Biden and Donald Trump took place in a tumultuous atmosphere. This event has revived concerns within the Democratic Party about the incumbent president's ability to run for another term. The US 10-year yield is currently trading around 4.27%, while its German counterpart is at 2.44%. Finally, the yen continues to face pressure, reaching its lowest level against the dollar in 37 years, fueling speculation about a possible intervention by the Bank of Japan to contain excessive volatility. Crypto: Bitcoin (BTC) sees its third consecutive week of decline. The digital currency has fallen nearly 3% since Monday, now hovering around $61,300. This week's drop is partly due to the start of repayments to customers affected by the 2014 Mt. Gox cryptocurrency platform hack. Ten years after the company's collapse, 140,000 bitcoins have been recovered from a hack that leaked 940,000 BTC. At the time of the bankruptcy, one bitcoin was worth $451 compared to $61,300 today. This suggests significant sales if creditors decide to take their profits, potentially driving BTC prices down. Meanwhile, ether (ETH) ends a four-week losing streak, rebounding modestly by 0.8% to around $3,450. |

|

|

| Things to read this week | ||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By