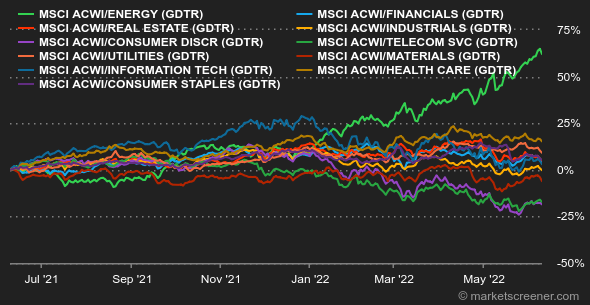

Atmosphere: Investors' hearts are still swaying between the rather strong macroeconomic data and a more uncertain future as central banks tighten the screws on rates. Reduced liquidity is having an increasing impact on the real economy. Friday's release of higher-than-expected U.S. inflation in May put a coin back into the stagflation machine, especially since some investors were hoping for a continuation of the decline that began in April. For its part, the ECB paved the way for rate hikes that it refused to consider just a few months ago.

Rates: The ECB has hardened its stance, because it cannot remain unresponsive to the inflation rates that are hitting the continent. As a result, the interest rate on sovereign debt has risen, with the riskiest signatures rising faster, as they should. The 10-year debt is now paying 4.23% in Greece and 3.62% in Italy. Swiss debt varies less but is now flirting with 1%, half the rate of the French OAT (2%). The euro zone benchmark, the Bund, is at 1.41%. In the United States, the 5-year yield (3.13%) rose above that of the 10-year (3.05%) and the 30-year (3.12%) shortly after the announcement of inflation figures on Friday.

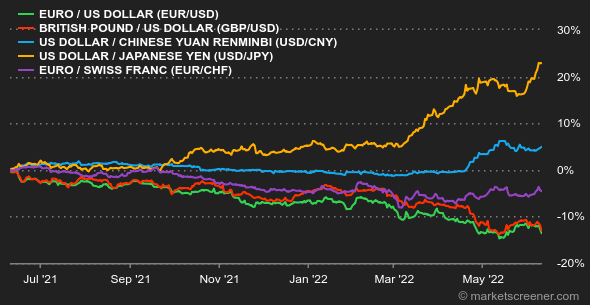

Currencies: The yen's record weakness continued to fall against the dollar, despite a small run by the Japanese currency at the end of the week. This is the price of the mismatch in strategy between a Fed resolutely committed to a rate hike cycle and a BOJ that has chosen not to move. A small incongruity on Friday: the Japanese political and monetary authorities were moved by the extent of the decline, which is quite rare. At that time, it took 133.35 JPY for 1 USD. Eight months ago, it was still JPY 110 to the USD. The euro/dollar pair remains stuck at its recent levels, between 1.06 and 1.07 USD per 1 EUR.

Cryptocurrencies: For bitcoin, the weeks have been one and the same for the past 1 month. The price has been languishing between $28,000 and $32,000, leaving crypto traders-investors wondering where the digital currency will go in the coming weeks. Although BTC ended a 9-week losing streak last Sunday, it could, in the medium term, continue to scare its aficionados in a macroeconomic context that is still not very favorable to risky assets.

Calendar: A particularly busy week in the United States with producer prices (Tuesday) and retail sales (Wednesday), followed by the U.S. central bank's decision on its rates and monetary policy (Wednesday evening). The Bank of England will also be in the game on Thursday at midday. Both central banks are facing very high inflation issues that make monetary policy complex.

|

By

By