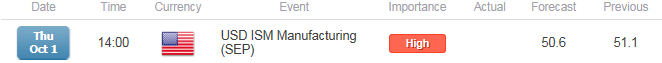

- U.S. ISM Manufacturing Survey Projected to Slow for Third Straight Month in September.

- Employment Component Narrowed the Last Two-Months, With the Last Print Standing at 51.2.

For more updates, sign up for David's e-mail distribution list.

Trading the News: U.S. ISM Manufacturing

A further slowdown in the ISM Manufacturing survey may dampen the appeal of the greenback and spur a short-term rebound in EUR/USD as it undermines expectations for a Fed rate hike later this year.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Even though Fed Chair Janet Yellen continues to endorse a 2015 liftoff, the ‘data dependent’ central bank may come under increased scrutiny to further delay its normalization cycle should the fundamental developments coming out of the U.S. economy cast a weakened outlook for growth and inflation.

For LIVE SSI Updates Ahead of the ISM Print, Join DailyFX on Demand

Expectations: Bearish Argument/Scenario

Release | Expected | Actual |

Durable Goods Orders ex Transportation (AUG) | 0.1% | 0.0% |

Industrial Production (MoM) (AUG) | -0.2% | -0.4% |

Advance Retail Sales (MoM) (AUG) | 0.3% | 0.2% |

U.S. firms may continue to scale back on production amid the ongoing weakness in private-consumption accompanied by the slowdown in global growth, and another downtick in the ISM survey may spur a bearish reaction in the greenback as it drags on interest rate expectations.

Risk: Bullish Argument/Scenario

Release | Expected | Actual |

Consumer Confidence (SEP) | 96.8 | 103.0 |

Gross Domestic Product (Annualized) (QoQ) (2Q F) | 3.7% | 3.9% |

Markit Purchasing Manager Index- Manufacturing (SEP P) | 52.8 | 53.0 |

Nevertheless, the recent recovery in consumer confidence along with the stronger-than-expected recovery in the second-quarter may encourage firms to boost production, and a positive development may instill a more bullish outlook for the greenback as it fuels bets for a 2015 Fed rate hike.

How To Trade This Event Risk(Video)

Bearish USD Trade: ISM Survey Narrows to 50.6 or Lower

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD.

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bullish USD Trade: Manufacturing Report Exceeds Market Expectations

- Need red, five-minute candle to favor a short EURUSD trade.

- Implement same setup as the bearish dollar trade, just in reverse.

Potential Price Targets For The Release

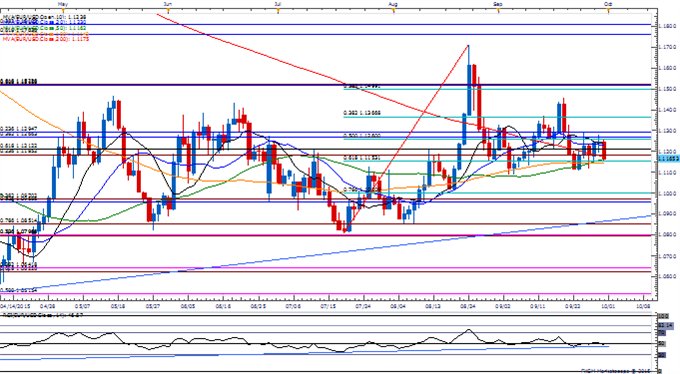

EURUSD Daily

Chart - Created Using FXCM Marketscope 2.0

- Risk trends may continue to influence EUR/USD as market participants treat the Euro as a ‘funding-currency,’ and the pair remains at risk for a larger rebound as it retains the opening range for September; waiting on a break of the bullish formation in the Relative Strength Index (RSI) to favor the downside targets.

- DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-short EUR/USD since March 9, but the ratio continues to narrow as it sits at –1.14, with 47% of traders long.

- Interim Resistance: 1.1760 (61.8% retracement) to 1.1810 (38.2% retracement)

- Interim Support: Interim Support: 1.0790 (50% expansion) to 1.0800 (23.6% expansion)

Read More:

EUR/USD Struggles Ahead of ECB Rhetoric- USD/JPY Range Under Pressure

AUDNZD at Critical Inflection Point- Scalps Eye Weekly Opening Range

Impact that the U.S. ISM Manufacturing report has had on EUR/USD during the last release

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

AUG 2015 | 09/01/2015 14:00 GMT | 52.5 | 51.1 | +1 | +79 |

August 2015 U.S. ISM Manufacturing

The U.S. ISM Manufacturing survey unexpectedly narrowed in August, with the figure slipping to a two-year low of 51.1 from 52.7 the month prior. A deeper look at the report showed a slowdown in New Orders and Production, with the Employment component narrowing for the second consecutive month, while New Export Orders contracted for the third month in August. Despite the weaker-than-expected print, it seems as though the Fed will stay on course to normalize monetary policy later this year as Chair Janet Yellen continues to see ‘transitory factors’ dragging on the economy. The greenback struggled to hold its ground following the dismal print, with EUR/USD climbing above the 1.1300 during the North American trade to end the day at 1.1313.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source