Talking Points

- USD crosses in focus heading into major central bank rate decisions, NFPs

- Monthly/weekly opening range to offer guidance heading into March trade

- Updated targets & invalidation points on EURUSD, GBPUSD, USDCAD & USDCHF

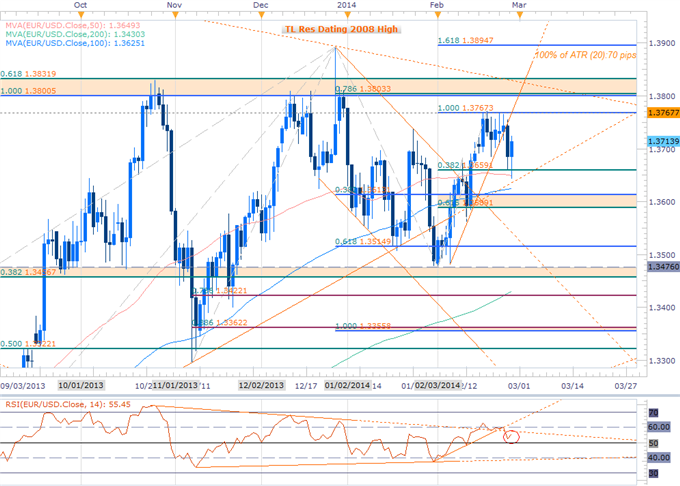

EURUSD Daily Chart

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- EURUSD reacts to key Fibonacci resistance at 1.3767

- Daily RSI failure to mount 60 / Support trigger break – bearish

- Weekly opening range support break- bearish

- Near-term support 1.3660- Break targets objectives at 1.3590/1.3613, 1.3515 & 1.3457/76

- Breach above 1.3767 resistance (bearish invalidation) targets 1.38, 1.3830 & 1.3895

- Key Events Ahead: Eurozone Unemployment data on Friday, ECB next week

Notes: Looking for the weekly/March opening range to offer further evidence that a more meaningful turn is materializing off of the 1.3767 resistance target highlighted in yesterday’s EURUSD scalp report. Use caution heading into the ECB rate decision on Thursday with the event likely to offer further clarity on our near-term directional bias.

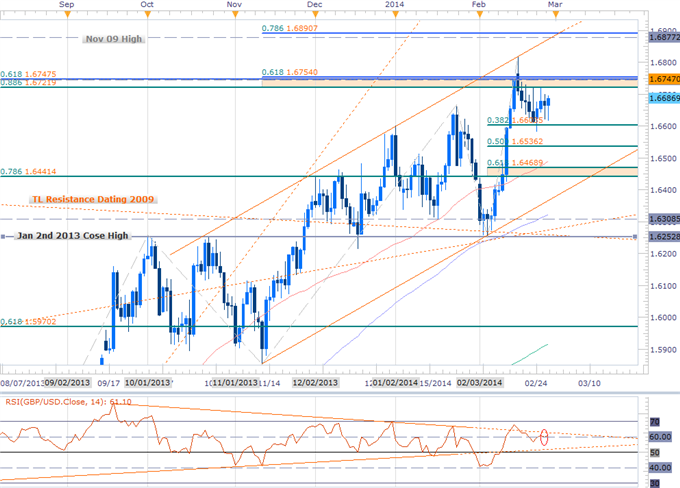

GBPUSDDaily Chart

Technical Outlook

- Key Resistance 1.6722/54- Long bias at risk below this level

- Breach targets objectives at 1.6877/90, 1.7040/65

- Interim support 1.66- Break targets larger correction off Feb high

- Support 1.6536, 1.6441/69- Broader trend constructive above 1.6252

- Daily RSI continues to respect 40-support / pending resistance trigger- bullish

- Key Events Ahead: BoE Rate Decisionnext week

Notes: 1.6722/54 represents a significant region of resistance and is defined by multiple longer-term key Fibonacci levels and the 2011 high. The pair has continued to respect this barrier on a close basis with the high close coming in exactly at 1.6742. We’ll be looking for the weekly/monthly opening ranges to form below this threshold with a break of said range likely to offer further guidance on a near-term bias heading into March trade.

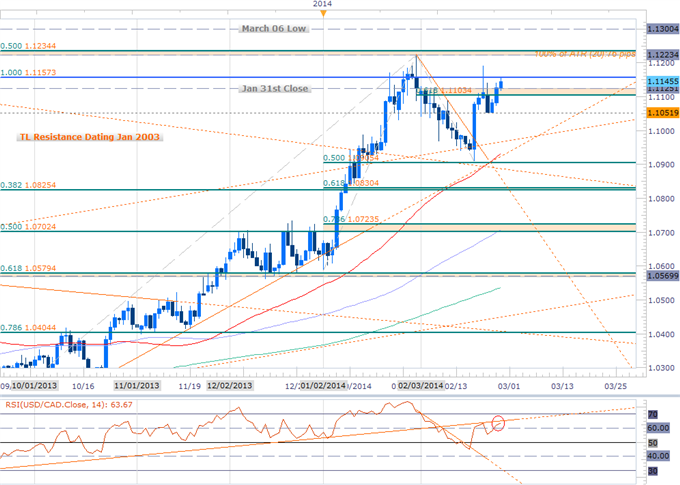

USDCAD Daily Chart

Technical Outlook

- USDCAD turns ahead of Fib support / TL resistance breach- bullish

- Outside key reversal on 2/19 / RSI resistance trigger break- bullish

- Topside resistance objectives at 1.1157, 1.1223/34&1.1300

- Support now 1.1050, 1.0906- bullish invalidation

- Break targets support at 1.0825/30 & 1.0702/24

- Key Events Ahead: BoC Rate Decision on Wednesday

Notes: The USDCAD scalp setup highlighted earlier this month has been in play with the first two primary objectives having been achieved. A breach/close above 1.1157 is critical to maintain our near-term topside bias and again we will look for the March opening range for conviction here. Failure to do so and a shift below this week’s low suggests more meaningful correction off the December high may still be in play. Look to the BoC rate decision on Wednesday with the Canadian employment report coinciding with NFPs on Friday.

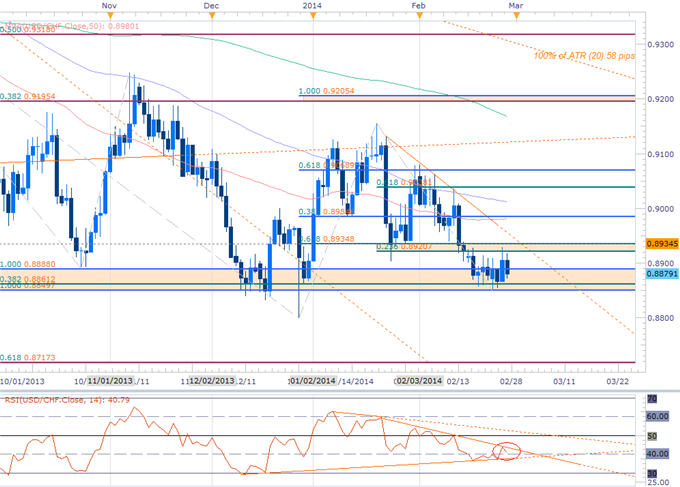

USDCHF Daily Chart

Technical Outlook

- USDCHF key support range in focus- 8850/88- bullish invalidation.

- Break risks losses into support targets at 8717 & 8670

- Resistance 8920/35, 9039, 9069

- Daily RSI trigger(s) pending

Notes: The 8850/88 support range is a key barrier we’ve noted since December as being a major inflection point for the USDCHF. Failure to close below this threshold puts the bearish bias at risk and the immediate focus is now weighted to the topside against this threshold. I’ve wanted to be on the long-side of this trade for some time now, but we just haven’t gotten the validation needed to fight this downtrend. That said, we’ll respect the March opening range while noting the risk of substantial losses with a break/close below 8850.

Follow the progress of these trade setups and more throughout the trading week with DailyFX on Demand.

Other Setups in Play:

- EURJPY Rally at Risk Sub 141- Weekly Opening Range in Focus

- GBPAUD Weekly Range in Focus- Bullish Scalp Bias at Risk Sub 1.86

- GBPCAD Challenging Feb Range High- Scalp Bias Bullish Above 1.8037

- AUDNZD Target Key Resistance- Bullish Scalp Bias at Risk Sub 1.09

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars next Monday on DailyFX and Tuesday- Thursday mornings next week on DailyFX Plus (Exclusive of Live Clients) at 1230 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

original source

By

By