Technavio has announced the top five leading vendors in their recentglobal polyolefin market report until 2021. This research report also lists 11 other prominent vendors that are expected to impact the market during the forecast period.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170111005458/en/

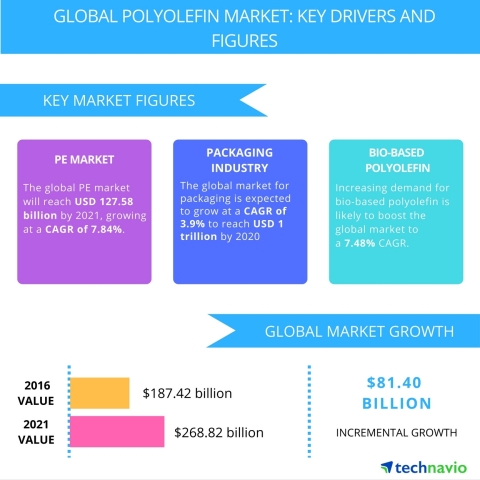

Technavio has published a new report on the global polyolefin market from 2017-2021. (Graphic: Business Wire)

Analysts at Technavio forecast the global polyolefin market to grow at a CAGR of more than 7% through the forecast period and is expected to be valued at USD 268.82 billion by 2021. By product type, this market is segmented into polyethylene, polypropylene, and functional polyolefins. The ergonomic growth in Asia is expected to drive the market during the forecast period.

“Geographically, the Americas dominate the global polyolefin market, with North America being the biggest contributor. The high demand for polyolefins from the packaging and construction industry is expected to drive the market growth through the forecast period. Additionally, declining feedstock prices have increased their consumption in several demographics, which will majorly affect the market growth,” says Ajay Adikari, one of the lead analysts at Technavio for olefins research.

Competitive vendor landscape

The global polyolefin market is dominated by the existence of a few large global manufacturers such as Arkema, CNPC, ExxonMobil, LyondellBasell, and SABIC. These players have a vast geographical presence with massive production facilities located globally. Nonetheless, there are a sizeable number of small regional vendors with significant shares in the market.

The key players can compete in the market in terms of innovations, price point, and quality of their products. Vendors consciously price their products to ensure that they gain a market edge over their competitors, which usually translates to larger players closing the deals. Additionally, the financial, technological, and other resources of some suppliers are better compared with their competitors, which enables them to withstand changes and adapt to different market conditions.

Request a sample report: http://www.technavio.com/request-a-sample?report=55479

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Top five vendors in the global polyolefin market:

Arkema

Arkema is a global player and manufacturer of chemicals and advanced materials. It serves the aerospace, aeronautics, automotive, electronics, oil, and consumer goods industries. The company acquired Bostik, a specialty adhesive company. The acquisition will benefit Arkema in elastic bonding, hot-melt pressure sensitive adhesive, and polymer-modified binder technologies. The company has a target of doubling the 2014 earnings before interest, taxes, depreciation, and amortization (EBITDA) of Bostik to about USD 343 million in 2020. We anticipate that this goal will play a significant role in the polyolefins market during the forecast period.

CNPC

CNPC is based in China, and has its presence in almost 70 countries worldwide. Its oil and gas operations are present in 37 countries across Africa, Central Asia-Russia, the Americas, the Middle East, APAC, and other regions. In 2015, polyolefin for gas pipes and additional 35 kinds of polyolefin products were developed by the company. In the chemicals business, the company made channels for sulfur export, established a regulatory model for naphtha-based polyolefin production, and locked in forward margin by leveraging Singapore’s paper market and China’s future market.

ExxonMobil

ExxonMobil is an oil and gas company. It uses technology and innovations to help meet world's growing energy demand. Company's products and services are offered in three segments: polymers, chemicals and fluids, and technology licensing and catalysts. End-user industries served by this company include the adhesives and sealants, agriculture, automotive, building and construction, consumer product, healthcare and medical, label, lubricant, nonwoven, and packaging industries.

The company offers different types of PE which are traded under the brand names Exceed and Enable. These are used in packaging, consumer and industrial products, greenhouse films, building and construction, hot-melt adhesives, and roads and highways. PP offered by the company include resins, which are marketed under the brand name Achieve and performance polyolefins marketed under the brand name Exxtral.

LyondellBasell

LyondellBasell is a plastic, chemical, and refining company, which is a member of the S&P 500. End-user industries served by this company include the packaging, electronics, automotive, home furnishing, construction material, and biofuel industries. The company is one of the largest producers of PP and its compounds, as well as a worldwide producer of PE.

SABIC

SABIC is a petrochemicals manufacturer. Its operating units include chemicals, plastics, agri-nutrients, metals, and specialties. It operates 60 production facilities across 50 countries, including the US, Spain, the Netherlands, Saudi Arabia, India, Japan, and the Republic of Korea.

SABIC is a major producer of PE and PP used in rigid materials for computers, refrigerators, car parts, industrial food packaging, and waterproof films. Some polyolefins have heat resistant properties due to which they are used in the microwaveable food packaging sector.

Browse Related Reports:

- Global Hot Melt Adhesives Market 2016-2020

- Global Caprolactam Market 2016-2020

- Global Bio-polypropylene (PP) Market 2015-2019

Become a Technavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like metals and minerals, paints, coatings, and pigments, and specialty chemicals. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170111005458/en/