Fidelity Investments® today announced that Morningstar, Inc. has named Steve Wymer, portfolio manager of Fidelity Growth Company Fund, as its 2017 U.S. Domestic-Stock Fund Manager of the Year.

This press release features multimedia. View the full release here: http://www.businesswire.com/news/home/20180124006093/en/

Steve Wymer of Fidelity® Growth Company Fund Honored as 2017 Morningstar Domestic-Stock Fund Manager of the Year (Graphic: Business Wire).

The annual Fund Manager of the Year award recognizes portfolio managers who demonstrate excellent investment skill and the courage to differ from the consensus to benefit investors. To qualify for the award, managers' funds must have not only posted impressive returns for the year, but the managers also must have a record of delivering outstanding long-term risk-adjusted performance and of aligning their interests with shareholders'. Managers' funds must currently have a Morningstar Analyst Rating™ of Gold or Silver.

In recognizing Wymer, Laura Pavlenko Lutton, Morningstar’s Director of Manager Research Practice, North America, stated, “Wymer’s success is a result of his time-tested investing approach, utilizing Fidelity’s research team and executing a thoughtful strategy that has played well in a growth-fueled market. Since Wymer’s start, the fund has beaten nearly all of its large-growth peers. Even in tough environments for active large-growth managers, it’s consistently outpaced its benchmark.”

“It’s truly an honor to be recognized for helping investors achieve their financial goals,” said Wymer. “This award is a reflection on Fidelity’s extraordinary equity research analysts who are critical to every portfolio manager’s success here at Fidelity.”

“We’re extremely proud that Morningstar has selected Steve as Fund Manager of the Year,” said Brian Hogan, president of Fidelity’s Equity and High Income division. “Steve is an exceptional investor who stands out even among Fidelity’s long list of outstanding portfolio managers. Fidelity Growth Company Fund is an excellent example of our heritage of active fund management, and the many Fidelity Funds that have delivered market-beating, long-term performance for their shareholders.”

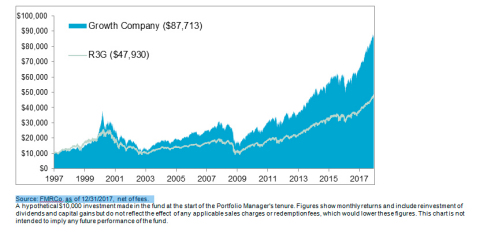

Fidelity Growth Company Fund is a $42 billion fund with a Morningstar Analyst Rating™ of Silver, which last year beat 96% of its Morningstar peers in the Large Cap Growth category. Over Wymer’s 21-year tenure on the fund, Fidelity Growth Company Fund has beaten 96% of its Morningstar peers and outperformed its benchmark Russell 3000 Growth Index by 3.15% per year as of December 31, 2017. An investment of $10,000 in Fidelity Growth Company Fund over Wymer’s tenure would be worth $87,713 as of December 31, 2017 vs. $47,930 for the benchmark -- $39,783 of outperformance. Of course, past performance is no guarantee of future results.

Fidelity Growth Company Fund - Average Annual Total Returns as of 12/31/17

| 1 Year | 3 Years | 5 Years | 10 Years | Expense Ratio | |||||||||||

Fidelity® Growth Company Fund | 36.76% | 16.06% | 19.74% | 11.44% | 0.77% | ||||||||||

| Russell 3000 Growth | 29.59% | 13.51% | 17.16% | 9.93% | |||||||||||

| Large Growth | 27.67% | 11.06% | 15.29% | 8.31% | |||||||||||

| Rank in Morningstar Category | 5% | 2% | 2% | 4% | |||||||||||

| # of Funds in Morningstar Category | 1363 | 1216 | 1109 | 787 |

The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so investors may have a gain or loss when shares are sold. Current performance may be higher or lower than the performance data quoted. See the most recent month-end performance.

About Fidelity Investments

Fidelity’s mission is to inspire

better futures and deliver better outcomes for the customers and

businesses we serve. With assets under administration of $6.8 trillion,

including managed assets of $2.4 trillion as of December 31, 2017, we

focus on meeting the unique needs of a diverse set of customers: helping

more than 26 million people invest their own life savings, 23,000

businesses manage employee benefit programs, as well as providing more

than 12,500 financial advisory firms with investment and technology

solutions to invest their own clients’ money. Privately held for 70

years, Fidelity employs more than 40,000 associates who are focused on

the long-term success of our customers. For more information about

Fidelity Investments, visit https://www.fidelity.com/about.

Before investing, consider the investment objectives, risks, charges, and expenses of the fund or annuity and its investment options. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stock involves risks, including the loss of principal.

Indexes are unmanaged. It is not possible to invest directly in an index.

Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any.

Expense ratio is the total annual fund operating expense ratio from the fund's most recent prospectus.

Russell 3000 Index is a market capitalization-weighted index designed to measure the performance of the broad growth segment of the U.S. equity market. It includes those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth rates.

For the one, three-, five- and 10-year periods ending 12/31/17, Fidelity Growth Company Fund’s rank in the Morningstar Large Growth category was 5%, 2%, 2% and 4%, respectively. There were 1363, 1216, 1109 and 787 funds in the Morningstar category over the same periods, respectively. Percent Rank in Category is the fund's total-return percentile rank relative to all funds that have the same Morningstar Category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. The top-performing fund in a category will always receive a rank of 1. % Rank in Category is based on total returns which include reinvested dividends and capital gains, if any, and exclude sales charges.

The Morningstar category average is the average return for the peer group based on the returns of each individual fund within the group, for the period shown. This average assumes reinvestment of dividends. Past performance is no guarantee of future results.

Morningstar’s Manager Research Group consists of various wholly owned subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC. Analyst Ratings are subjective in nature and should not be used as the sole basis for investment decisions. Analyst Ratings are based on Morningstar’s Manager Research Group’s current expectations about future events and therefore involve unknown risks and uncertainties that may cause such expectations not to occur or to differ significantly from what was expected. Analyst Ratings are not guarantees nor should they be viewed as an assessment of a fund’s or the fund’s underlying securities’ creditworthiness. This press release is for informational purposes only; references to securities in this press release should not be considered an offer or solicitation to buy or sell the securities.

The Manager of the Year award is presented each year to recognize a

manager’s past achievements.

Morningstar fund analysts specializing

in the fixed income field narrow the universe for the award to five

nominees, and the winner is then selected by Morningstar’s entire team

of mutual fund analysts. The award is presented to fund managers who

have distinguished themselves over the past calendar year and have

achieved strong risk-adjusted historical performance through the careful

execution of a solid investment strategy and responsible fund

stewardship.

The Morningstar Analyst Rating is a subjective, forward-looking

evaluation that considers a combination of qualitative and quantitative

factors to rate funds on five key pillars: process, performance, people,

parent, and price. Gold is the highest of four Analyst Rating categories.

For

the full rating methodology, go to Morningstar.com

For

the Fidelity Growth Company Fund report, go to http://performance.morningstar.com/fund/ratings-risk.action?t=FGCKX.

© 2018 Morningstar, Inc. All rights reserved. The Morningstar information contained herein (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or redistributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Fidelity does not review the Morningstar data and, for mutual fund performance, you should check the fund's current prospectus for the most up-to-date information concerning applicable loads, fees, and expenses.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem

Street, Smithfield, RI 02917

Fidelity Investments Institutional Services Company, Inc.,

500

Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC,

200 Seaport

Boulevard, Boston, MA 02110

831992.1.0

©2018 FMR LLC. All rights reserved.

View source version on businesswire.com: http://www.businesswire.com/news/home/20180124006093/en/