So, in theory, the price of gold should be soaring right now.

To get a better understanding of this paradox, we’ll take a look at the various elements that have an impact on the gold price in this article.

1. The effect of the dollar and emerging currencies

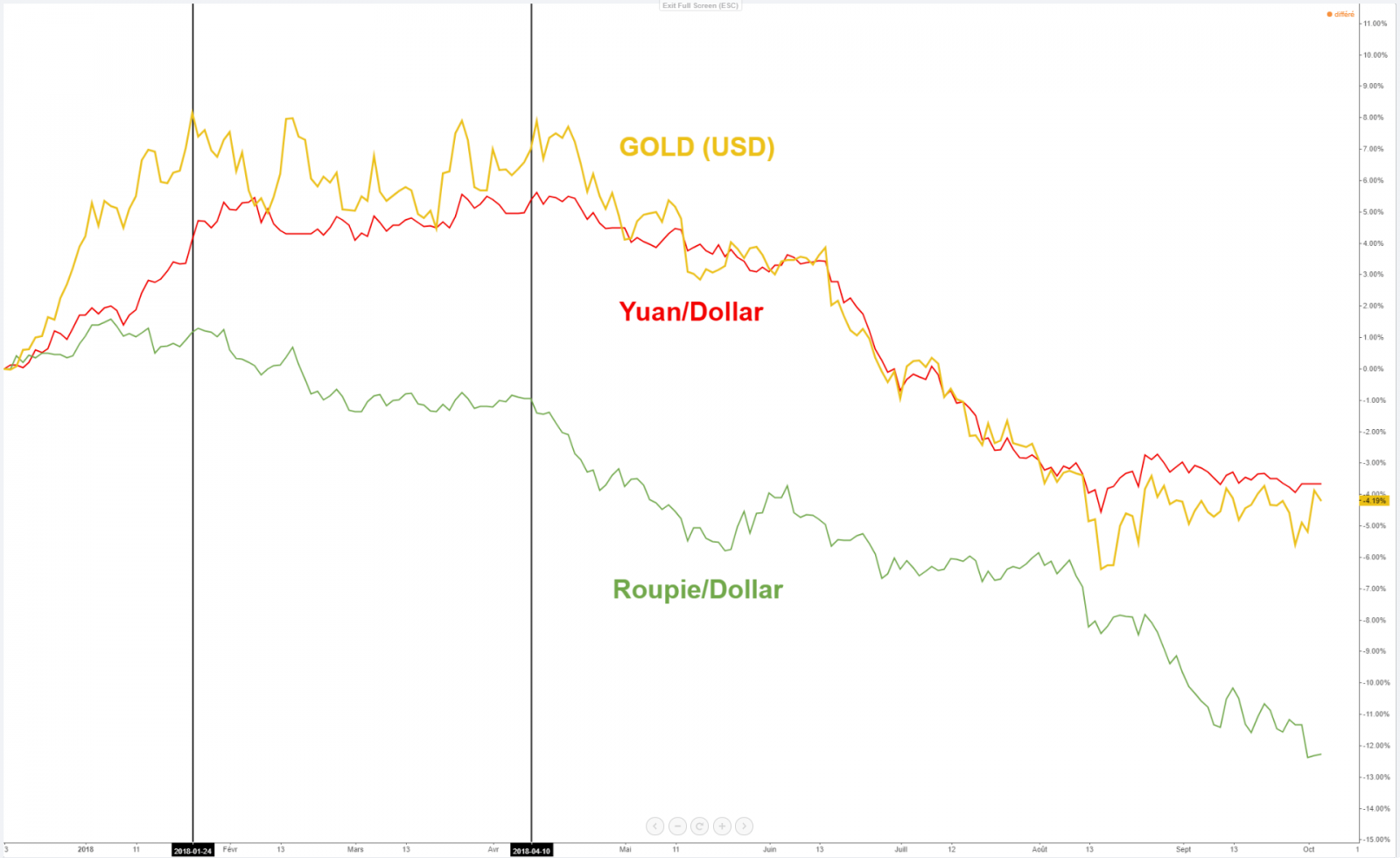

The inverse relationship between the dollar and commodities denominated in dollars is commonly known. Generally speaking, a falling dollar implies a rising gold price (since the latter is denominated in dollars) and vice versa.

Understanding this relationship comes down to understanding the attractiveness of gold among the holders of other currencies. In other words, the stronger the dollar is against its counterparts, the weaker the purchasing power of the latter will be. This, in turn, implies a lower demand and eventually will lead to lower gold prices.

This is where the evolution of emerging currencies since the beginning of the year comes into play. For various reasons, these currencies keep losing ground, a phenomenon that affects more and more countries. On average, emerging currencies have lost more than 16% of their value since February, more than enough to considerably weaken the purchasing power of these countries when it comes to buying the in dollar-denominated gold.

In order to try and stop the fall of their currency, some emerging countries had to sell a part of their gold reserves via their Central Bank, something that has also fuelled the fall of the gold price.

2. Monetary policy and real interest rates

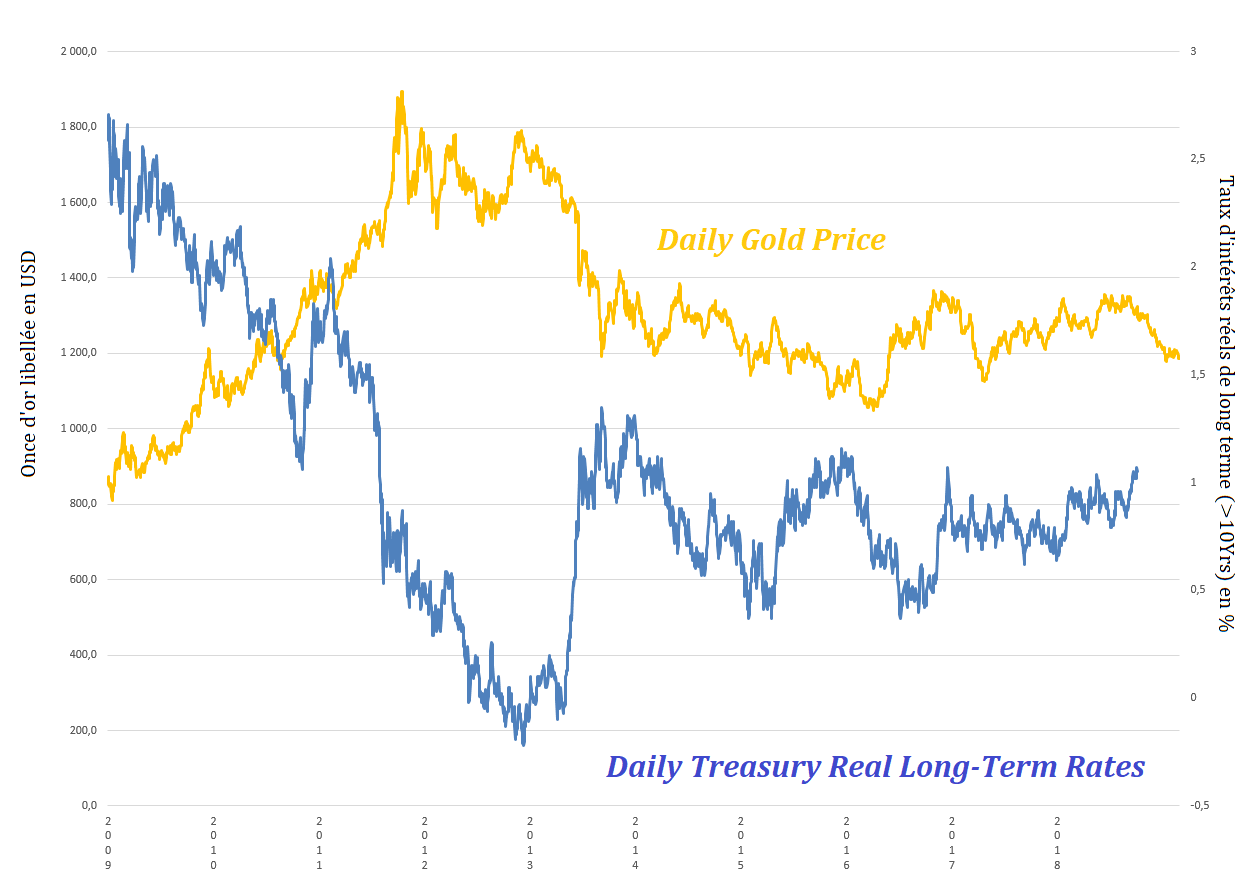

A rise of the inflation doesn’t necessarily mean a rise in the gold price. Just like an interest rate hike doesn’t always imply a lower gold price.

This is something we clearly see as a result of the current policy of the Fed. The latter has recently increased its interest rate for the second time this year with a quarter of a percentage point and is planning to do this again before the end of the year. The idea is to avoid an overheated US economy.

When the interest rates increase faster than the inflation the real interest rates go up. As a result, gold - which doesn’t offer any return - loses its attractiveness. In other words: with a similar liquidity, an investor who can choose between a US Treasury note that pays interest or an ounce of gold that doesn’t is likely to pick the former.

Evolution of the gold price (denominated in Dollars) and the real, long-term interest rates in the US

3. The bull market and safe haven

It’s virtually impossible to talk about gold without mentioning its safe haven side. This implies that gold is particularly popular when the stock market returns collapse. In other words: uncertainty, generally in combination with a higher volatility, and investors cashing in their profits on the stock market are the gold price’s best friend.

This year, however, despite some tangible tensions on the geopolitical and trade front and subsequent periods of profit taking, investors haven’t abandoned the stock market for other asset classes.

In fact, Wall Street currently goes through the longest bull market in its history. Needless to say, the longevity of the bull cycle doesn’t serve the gold metal well.

So, when will the gold price go up again?

Given the above, it’s not very likely that the gold price will rise any time soon. But it’s not impossible. If you’re looking to invest and diversify your portfolio with gold, it’s good to keep the following elements in mind:

1. A rise of emerging currencies: as we mentioned, an appreciation of emerging currencies - in particular, the Yuan and the Rupee - against the dollar will have a positive impact on the purchasing power of Asian buyers (the biggest contributors to the demand for gold).

2. A decline in real interest rates: this comes down to mainly two things. On the one hand, the inflation needs to rise. This is something that’s possible given the tensions on the US labor market and the rise of the energy prices. On the other hand, the nominal interest rates shouldn’t go up too quickly, the Fed will need to perform a delicate balancing act here.

3. An erosion of stock market returns: more and more market watchers worry about a potentially overheated US economy. If this scenario plays out, that would necessarily lead to a recession which in turn would lead to the end of the bull markets.

By

By