Technavio analysts forecast the global automotive differential market to grow at a CAGR of over 6% during the forecast period, according to their latest report.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170104006136/en/

Technavio has published a new report on the global automotive differential market from 2016-2020. (Graphic: Business Wire)

The research study covers the present scenario and growth prospects of the global automotive differential market for 2016-2020. The report presents the vendor landscape and a corresponding detailed analysis of the major vendors operating in the market.

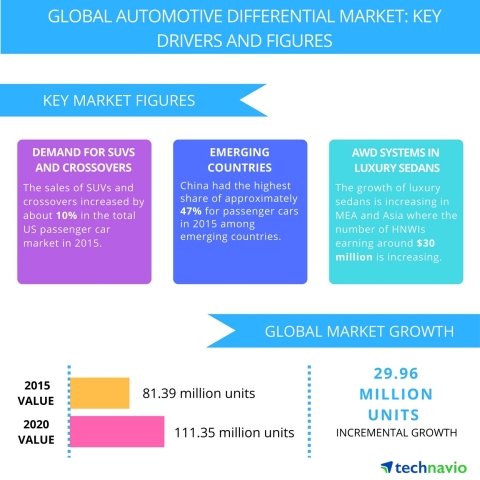

Increasing demand for SUVs and crossovers worldwide and the resurgent US auto industry, where the sales of SUVs, crossovers, and passenger cars have increased on a year-on-year basis, drive the global market for automotive differentials. The low penetration of cars in the rapid growing markets of emerging countries such as China, India, Brazil, and Indonesia also contribute to the growth of the global market for automotive differentials.

Request a sample report: http://www.technavio.com/request-a-sample?report=55473

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Technavio automotive analysts highlight the following three factors that are contributing to the growth of the global automotive differential market:

- Increasing demand for SUVs and crossovers

- Resurgent US auto industry

- Low penetration of cars in emerging countries

Increasing demand for SUVs and crossovers

The sales of SUVs and crossovers increased by about 10% in the total US passenger car market in 2015. Increasing preference for comfortable rides over long distances, three-row seats, and extra boot space in crossovers and SUVs are the main drivers for their growth in the US. Although both SUVs and crossovers look similar, they are distinct in fuel efficiency and usability.

Praveen Kumar, a lead powertrain research analyst at Technavio, says, “Crossovers are highly fuel efficient compared to SUVs as they are built from car frames and are considerably lightweight. Most American customers prefer space and higher riding profile. Crossovers usually weigh less than SUVs as SUVs are built from truck frames, leading to high curb weight for the vehicle.”

Resurgent US auto industry

In 2005, oil prices increased and reached its peak by 2008. American car manufacturers were highly dependent on gasoline driven light trucks for profit, which lead to the fall in sales of vehicles. The automotive industry crisis occurred in 2008-2010 with the big three automakers of the US: Ford, General Motors, and Chrysler in a weak financial position and the financial crisis of the companies compelling automakers to ask for financial aid from the US federal government.

“The auto leasing interest rates in the US have decreased over the years, leading to the increase in the sales of cars. There has been a growing demand for new vehicle loans due to the decline in auto loan interest rate, contributing to the increase in sales of cars in the US,” adds Praveen.

Low penetration of cars in emerging countries

China had the highest share of approximately 47% for passenger cars in 2015 among the emerging countries. China had a market size of 21.14 million units in the passenger cars segment in 2015, which is expected to increase to 29.73 million units by 2020. China is the world’s largest automotive market and the volume of units of passenger cars, and high growth rate is expected to drive the market as there is more scope for growth in China in terms of passenger cars.

In terms of China’s geography, the tier 3 and tier 4 Chinese cities contributed to a 40% increase in the sales of new cars in 2011 from 2002. It is estimated that around 60% of the new car sales will come from the smaller tier 3 and tier 4 cities.

Top vendors:

- GKN

- BorgWarner

- ZF

- Eaton

- Schaeffler

Browse Related Reports:

- Global Automotive Powertrain Sensors Market 2017-2021

- Global Automotive Hydro Mechanical Variable Transmission Systems Market 2016-2020

- Global Flex Fuel Engine Market 2016-2020

Become a Technavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like automotive electronics, automotive services, and wheels and tires. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170104006136/en/