Talking Points:

- Daily Trend Line Break in GBP/AUD

- Price Reacting Off Short-Term Support

- Looking for a Second-Chance Entry Signal

After some prolonged choppiness this week, it was certainly a welcomed sight to see the GBPCAD trade we profiled here yesterday move violently in our favor. However, traders will note that the bulk of the move was actually supported by the Canadian dollar (CAD), and not the British pound (GBP), which has instead continued somewhat sideways.

Thus, today's GBPAUD trade, which also favors the long side, is intended to catch a move up in the pound while also benefiting from a potential weakening in the Australian dollar (AUD).

Traders often wait impatiently for price to come towards a trend line, but when it is actually tested, they fear the entry, wondering whether the trend line will hold. In line with the dictum that it is better to trade “with the trend,” the assumption that it will hold at some point is usually better than the alternative.

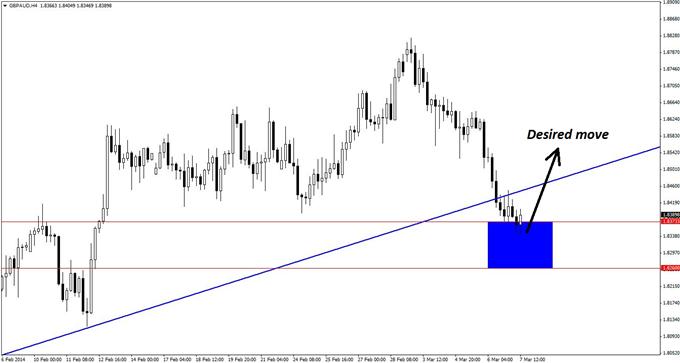

In the case of GBPAUD, it is best to treat the break of the trend line on the below daily chart as a false signal, or at least one that will generate a retest of the broken trend line.

Guest Commentary: Daily Trend Line Break for GBP/AUD

The four-hour chart below shows that price is already at support that has been generated from past horizontal price action. The desired move to the upside has in excess of 400 pips to reach the previous high. Meanwhile, the support zone is 1.8260-1.8373, or 113 pips deep. This clearly represents a favorable risk profile, making this long set-up in GBPAUD one worthy of consideration.

Guest Commentary: Key Support Zone for Buying GBP/AUD

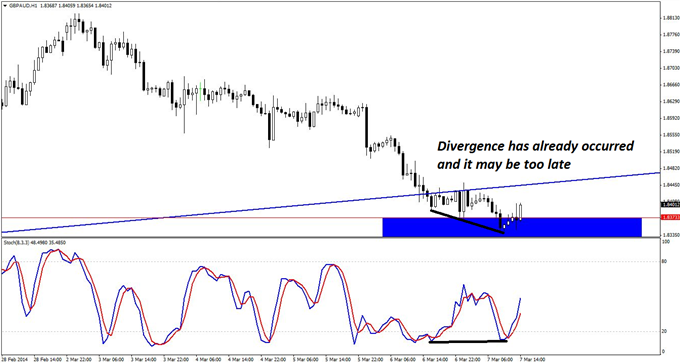

The hourly chart, however, reveals some complications with regard to this trade's entry.

As shown below, bullish reversal divergence is already visible on the hourly chart, and price is beginning to turn up. Although the more intrepid traders may be tempted to hop on, this market environment is still far from safe, and as a result, the preferred entry trigger would be for price to make a lower low and flash another divergence signal. It is also possible to enter on a pin bar or bullish engulfing pattern once that lower low is made.

Guest Commentary: Awaiting Another GBP/AUD Entry Signal

If price runs up without providing one more swipe for entry, then it is likely better to miss this trade than to try and hop onto it too early (or perhaps too late). If it does come back down, then two or three tries at the entry would be appropriate given the attractive nature of this set-up.

By Kaye Lee, private fund trader and head trader consultant, StraightTalkTrading.com

original source

By

By